When I took on a Dubai real estate agency with just 50 monthly website visits in early 2024, they were paying three different vendors AED 35,000 monthly for mediocre results. Six months later, traffic hit 44,800 monthly visits—a combination of organic search and strategic paid advertising working together like they’re supposed to.

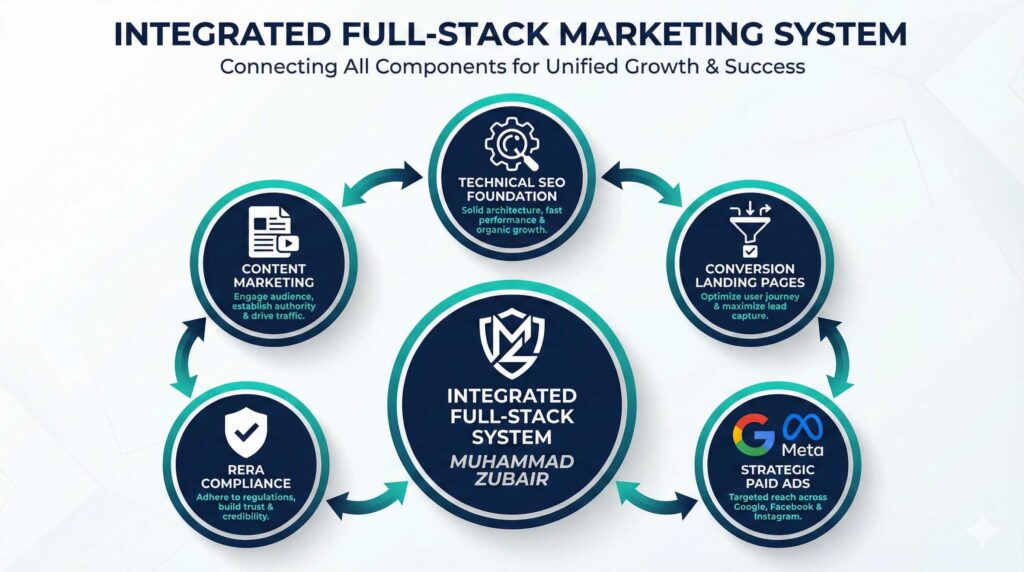

That’s not luck. It’s what happens when you stop treating SEO, paid ads, web design, and content as separate silos and start building an integrated marketing system designed specifically for Dubai’s property market.

Dubai’s real estate sector just recorded Dh525.87 billion in property sales across 168,540 transactions in the first 290 days of 2025—surpassing all of 2024. The market is on fire. Residential prices jumped 20% in 2024, with villas outperforming apartments and Dubai’s population exceeding 3.8 million residents.

But here’s what most agencies don’t understand: this explosive growth means nothing if your marketing can’t capture it. You’re competing against developers with nine-figure budgets and international agencies flooding the market with generic strategies that don’t work in Dubai.

After 6+ years managing digital marketing campaigns exclusively for Dubai real estate agencies, healthcare companies, and e-commerce brands, I’ve learned exactly what works in this market—and what’s a complete waste of money. This guide shows you the precise blueprint I used to transform that property agency from invisible to dominant in their segment.

🚀 Dubai Real Estate Marketing Cost Calculator

See how much you can save with an integrated full-stack approach

Click Each Component to Learn More

6-Month Implementation Roadmap (Click Each Phase)

- Core Web Vitals optimization (LCP, FID, CLS)

- RERA permit setup and Form A documentation

- Schema markup implementation

- Landing page template creation

- Analytics and conversion tracking setup

- Neighborhood-specific content publication

- Off-plan property landing pages

- Virtual tour integration

- Local SEO optimization

- Authority building and backlinks

- Google Ads campaigns (ready, off-plan, investment)

- Meta Ads for international buyers

- A/B testing and optimization

- Budget scaling for winners

- Geographic expansion campaigns

Why Traditional Real Estate Marketing Fails in Dubai (And What Actually Works)

Most Dubai real estate agencies are bleeding money on marketing strategies designed for New York or London. They hire an SEO agency that’s never dealt with RERA compliance, a Google Ads manager who doesn’t understand Dubai’s property investor mindset, and a web designer who builds beautiful sites that convert at 0.5%.

The result? AED 30,000+ monthly expenses, a fragmented strategy, and mediocre results that barely justify the cost.

Dubai’s real estate market operates under unique dynamics that international agencies fundamentally misunderstand. Property prices in Dubai increased 10% through May 2025 according to ValuStrat, with villas in Jumeirah Islands up 41% year-over-year and Palm Jumeirah villas climbing 40%. The average villa price now sits 66% above the 2014 market peak.

But here’s the critical insight: this isn’t a traditional buyer’s market. Dubai attracts property investors from Russia, France, and GCC countries looking for Golden Visa opportunities through AED 2 million+ property ownership. These buyers have completely different search behavior, intent signals, and conversion triggers than residential homebuyers.

When I optimized that real estate client’s strategy, the first thing I did was throw out their generic “property for sale Dubai” keyword targeting. Instead, we focused on specific entities: DAMAC Islands, Dubai Hills Estate, off-plan payment structures, RERA compliance guarantees, and DLD (Dubai Land Department) transaction data. We targeted property investors, not just homebuyers.

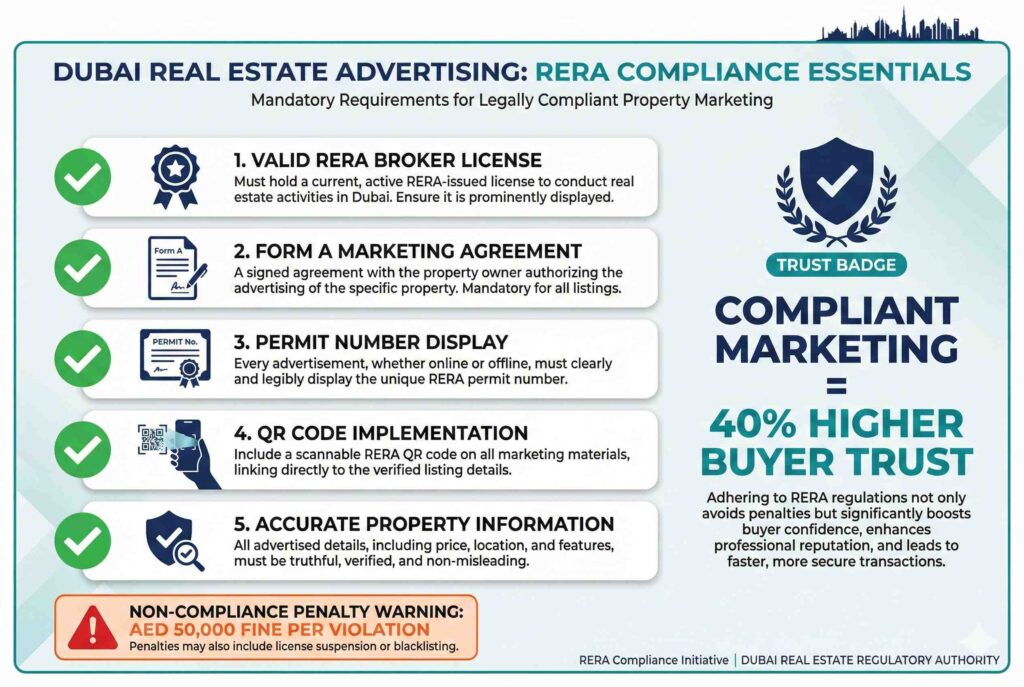

The Real Estate Regulatory Agency (RERA) adds another layer that most international marketers ignore. Every property advertisement in Dubai requires a RERA permit number obtained through the Trakheesi System. Advertisements without valid permits face AED 50,000 fines, and in 2024 alone, RERA issued warnings to 23 brokerage firms for violating advertising regulations.

Your SEO strategy needs to account for Form A requirements (marketing agreements between property owners and brokers), QR code mandates for property listings, and ethical advertising standards that Dubai enforces aggressively. Generic SEO doesn’t cut it here.

The Complete Real Estate Marketing Blueprint That Replaced 5 Agencies

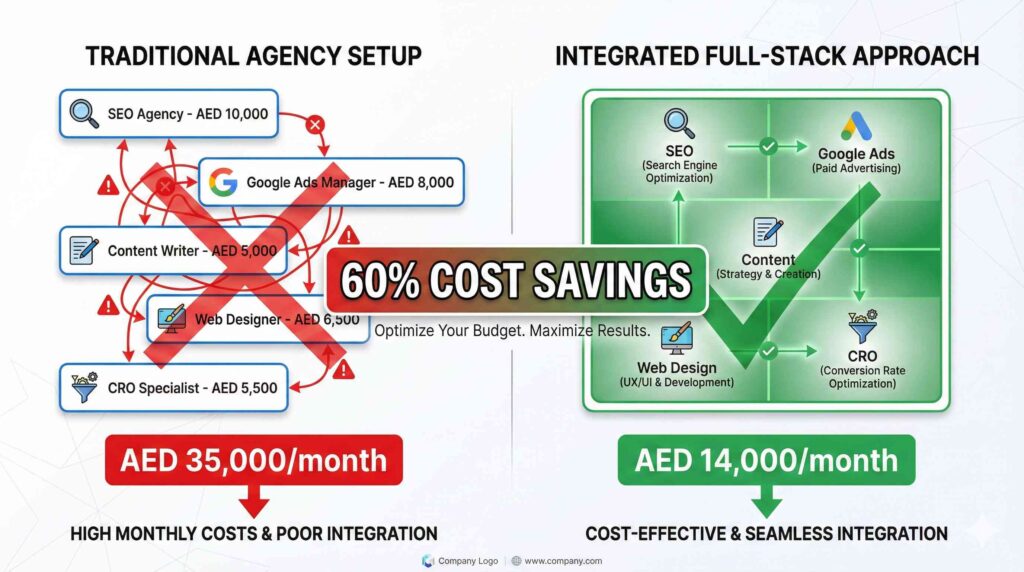

Here’s what most Dubai property agencies pay monthly:

- SEO agency: AED 8,000-12,000

- Google Ads manager: AED 6,000-10,000

- Content writer: AED 4,000-6,000

- Web designer: AED 5,000-8,000

- CRO specialist: AED 4,000-7,000

Total: AED 27,000-43,000 monthly for a fragmented approach where nobody talks to each other.

The SEO team optimizes pages that the ads manager never links to. The content writer creates blog posts, the web designer buries three clicks deep. The CRO specialist can’t test properly because the developer takes two weeks to implement changes. You’re paying for coordination overhead, not results.

My approach eliminates that entire mess. Everything works together from day one because one person controls the entire system:

Technical SEO Foundation: Core Web Vitals optimization, mobile performance, schema markup for real estate properties, local SEO for Dubai neighborhoods, and RERA-compliant site structure.

Conversion-Optimized Landing Pages: Property-specific pages designed to convert Dubai’s unique buyer segments—international investors, Golden Visa seekers, off-plan buyers, and luxury property clients.

Strategic Paid Advertising: Integrated Google Ads and Meta Ads campaigns where organic rankings inform paid keyword selection and paid ads generate data that improves organic content strategy.

Content Marketing Authority: Neighborhood guides, property investment analysis, Dubai market reports, and educational content that positions you as the Dubai market expert—not just another listing aggregator.

CRO and Funnel Optimization: Continuous testing, conversion tracking, lead qualification systems, and funnel improvements based on actual buyer behavior data.

When I grew that client from 50 to 44,800 monthly visits, the breakthrough wasn’t one brilliant tactic. It was eliminating the waste of five vendors working against each other and replacing them with one integrated system at 60% lower cost. The SEO strategy informed paid ads targeting. Paid ads data revealed content gaps. Content attracted organic traffic that fed retargeting campaigns.

Everything worked together. That’s why the results came so fast.

Step 1: Building Your Technical SEO Foundation (Core Web Vitals for Property Sites)

51% of real estate website traffic comes from organic search, making SEO the foundation of sustainable lead generation. But technical SEO for Dubai property sites requires specific optimizations most agencies miss.

Core Web Vitals—Google’s user experience metrics measuring loading speed, interactivity, and visual stability—matter significantly more for property sites than typical business websites. Why? Because 74% of homebuyers use mobile devices in their property search process, and Dubai’s luxury property audience expects instant page loads and flawless mobile experiences.

Your Largest Contentful Paint (LCP) should hit under 2.5 seconds. Property images are usually your LCP element, so implement WebP format, lazy loading for below-fold images, and CDN delivery for international buyers accessing your site from Russia, France, or GCC countries. For that real estate client, optimizing image delivery alone improved LCP by 40%.

First Input Delay (FID) measures interactivity. Property sites need interactive virtual tour embeds, map widgets, mortgage calculators, and lead capture forms—all JavaScript-heavy elements that destroy FID if poorly implemented. Use code splitting, defer non-critical JavaScript, and optimize third-party scripts like Matterport virtual tours or Google Maps embeds.

Cumulative Layout Shift (CLS) kills mobile conversions. When property images load late and shift the page layout, mobile users accidentally click the wrong buttons. Reserve space for images with explicit width and height attributes, load fonts properly to prevent text reflow, and test on actual mobile devices—not just Chrome DevTools.

Schema markup for real estate is non-negotiable. Implement the Organization schema with your RERA license details, the LocalBusiness schema for your office locations, the RealEstateListing schema for individual properties, and the FAQPage schema for property-specific questions. This structured data helps Google understand your content context and can trigger rich results in search.

Dubai Land Department (DLD) data integration builds trust and authority. Reference actual transaction volumes, price trends by neighborhood, and developer completion rates in your content. When I mention that Dubai Hills Estate, Palm Jumeirah, and Al Furjan ranked highest for villas in Q1 2025, that’s not marketing fluff—it’s DLD data that establishes topical authority.

Local SEO for Dubai neighborhoods separates serious players from listing aggregators. Don’t just optimize for “Dubai real estate”—target Jumeirah Village Circle (JVC), Dubai Marina, Business Bay, Downtown Dubai, Palm Jumeirah, Dubai Hills Estate, and specific developments like DAMAC Hills or Arabian Ranches. Create location-specific content that demonstrates deep knowledge of each area’s property types, price ranges, and buyer demographics.

When I achieved #1 Google ranking for “Damac Island Investment”—one of the most competitive real estate keywords in Dubai—the strategy wasn’t keyword stuffing. It was comprehensive entity coverage: DAMAC as a developer, Dubai Islands as a location, off-plan investment structures, payment plans, ROI projections, and RERA compliance requirements all covered in depth on one authoritative page.

Step 2: Mastering Off-Plan Property Marketing (The Dominant Dubai Segment)

Off-plan properties—units sold before construction completes—dominate Dubai’s real estate market in 2025. Developers offer flexible payment plans that lower entry barriers for property investors, and approximately 182,000 units are expected for delivery in 2025-2026, with 76,000 units completing in 2025 alone.

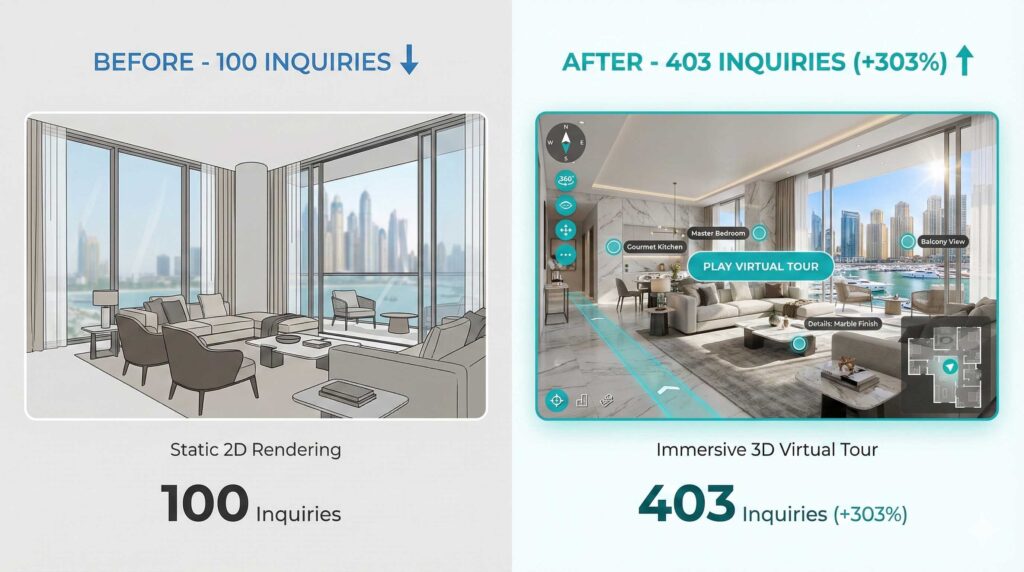

This creates a unique marketing challenge. You’re selling something that doesn’t physically exist yet. Virtual tours, 3D renderings, developer track records, and payment structure transparency become critical conversion factors.

RERA compliance for off-plan advertising is stricter than ready property marketing. Every off-plan advertisement requires a RERA permit obtained through Form A agreements between property owners (developers) and real estate brokers. The permit number must appear on all marketing materials, and since 2024, RERA mandates QR codes on property advertisements providing instant access to permit verification and property details.

Targeting property investors versus end-users requires completely different messaging. Property investors care about ROI projections, rental yield estimates, capital appreciation potential, and exit strategies. They search for terms like “Dubai property investment returns,” “off-plan payment plans,” and “Golden Visa property requirements.”

End-users—people actually planning to live in the property—care about lifestyle amenities, school proximity, community features, and neighborhood characteristics. They search for “family-friendly communities Dubai” or “beachfront apartments Palm Jumeirah.”

Most agencies try to target both with generic content. That’s a mistake. Segment your campaigns and create dedicated landing pages for each audience with messaging that speaks directly to their primary concerns.

Virtual tours and 3D renderings are non-negotiable for off-plan marketing. Listings with video receive 403% more inquiries than those without, and for properties that don’t physically exist yet, video walkthroughs of completed model units or 3D rendered tours are the only way buyers can visualize the final product.

Virtually staged listings sell 75% faster than those without virtual staging, and homes marketed with virtual staging sell at or above asking price 83% of the time. For off-plan properties, virtual staging isn’t optional—it’s the baseline expectation.

International buyer targeting is where Dubai off-plan marketing gets interesting. Dubai real estate is primarily bought by people from Russia, France, and Gulf countries, each with different purchase motivations, budget ranges, and preferred property types.

Russian buyers often seek Golden Visa eligibility through AED 2 million+ purchases and favor Dubai Marina, Downtown Dubai, and Palm Jumeirah for luxury waterfront properties. French buyers tend toward family communities like Arabian Ranches and Dubai Hills Estate. GCC buyers frequently purchase multiple units as investment portfolios in mid-market developments like JVC or Business Bay.

Your targeting strategy should account for these geographic and psychographic differences. Run separate ad campaigns by nationality, create content in relevant languages (Russian property guides convert significantly better than English-only content for Russian buyers), and understand visa regulations, ownership laws, and financial transfer processes for each market.

Lead generation costs for off-plan properties vary dramatically by source. Industry benchmarks suggest AED 30,000 monthly for 150 qualified leads—that’s AED 200 per lead. But quality matters more than quantity. Ten qualified investors ready to purchase are worth more than 150 tire-kickers who’ll never convert.

For that client who grew from 50 to 44,800 visits, we reduced cost-per-lead by 40% through better targeting and conversion optimization. Instead of buying leads from aggregators, we built our own lead generation system through SEO, targeted paid ads, and conversion-optimized landing pages. The leads cost less and converted better because they found us through educational content, not aggressive retargeting ads.

Step 3: Building Real Estate Conversion Funnels That Actually Convert

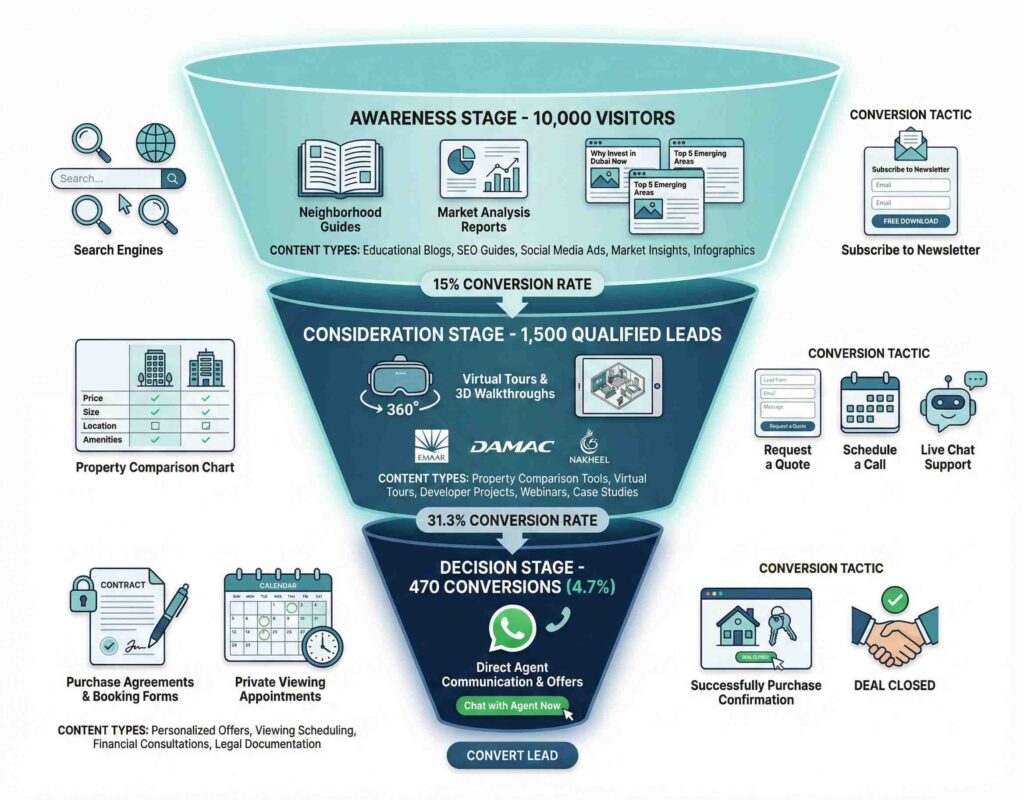

96% of homebuyers search for properties online, but most still convert offline through in-person viewings and broker relationships. Your marketing funnel needs to bridge that online research → offline conversion gap seamlessly.

The real estate funnel has three distinct stages, and most agencies fail by treating all visitors the same:

Awareness Stage: Buyers researching neighborhoods, comparing property types, and learning about Dubai’s market. They’re searching “best areas for families Dubai” or “off-plan vs ready property Dubai.” They’re not ready to buy—they’re gathering information.

Your content for this stage should be educational and helpful without aggressive sales pitches. Neighborhood guides, market trend analysis, property investment fundamentals, and Dubai homebuying process explanations work well. Capture email addresses through content downloads like “Dubai Property Buyer’s Guide” or “2025 Dubai Real Estate Market Report.”

Consideration Stage: Buyers narrowing their search to specific developments, comparing prices across similar properties, and evaluating developers. They’re searching “DAMAC Hills vs Arabian Ranches” or “Dubai Marina apartments under AED 2 million.”

This stage needs property-specific landing pages with detailed information, virtual tours, floor plans, payment structures, and developer backgrounds. Include social proof—testimonials from previous buyers, developer track records, completion statistics. Make it easy to schedule viewings or request additional information through simple lead capture forms.

Decision Stage: Buyers ready to make offers, comparing final financing options, and negotiating terms. They’re searching very specific queries like “Emaar Beachfront payment plan” or “Dubai property mortgage calculator.”

This stage requires immediate response systems. Phone numbers prominently displayed, WhatsApp integration for instant messaging (critical in Dubai’s market), mortgage calculator tools, and clear calls-to-action to schedule viewings or speak with licensed brokers.

Landing page optimization for property listings determines whether your traffic converts or bounces. The average real estate industry conversion rate is 4.7%, with organic search converting at 3.2% and paid search at 1.5%. If your landing pages convert below these benchmarks, you’re wasting ad spend.

Property landing page essentials include:

- Hero image or video showcasing the property’s best feature

- Clear headline stating property type, location, and key selling point

- Prominent lead capture form above the fold (name, phone, email—nothing more)

- Virtual tour embed or photo gallery

- Property specifications (bedrooms, bathrooms, square footage, amenities)

- Developer information and track record

- Payment plan details

- RERA permit number and QR code (compliance requirement)

- Neighborhood map showing schools, metro stations, and shopping centers

- Similar properties section

- Trust signals (developer partnerships, RERA license, years in business)

Virtual tours deserve special attention. Video content generates 1,200% more shares than text and image posts combined on social media, and 73% of homeowners are more likely to list with realtors who use video marketing. For Dubai’s property market, where international buyers may purchase without visiting in person, high-quality virtual tours are conversion multipliers.

WhatsApp integration isn’t optional in Dubai—it’s expected. Most leads expect instant responses through WhatsApp messaging, not email follow-ups 24 hours later. Implement WhatsApp Business API with automated greeting messages, quick replies for common questions, and prompt handoff to licensed brokers for qualified leads.

Email nurture sequences keep leads engaged through the typical 3-6 month Dubai property purchase timeline. Email marketing has a 3,600% ROI and converts 40% better than social media for real estate. But generic newsletter blasts don’t work.

Segment your email list by:

- Property type interest (villas, apartments, townhouses)

- Budget range (under AED 1M, AED 1-2M, AED 2M+, luxury AED 5M+)

- Buyer type (investor vs end-user)

- Purchase timeline (actively searching vs researching for future purchase)

- Geographic origin (UAE residents, international buyers by country)

Send targeted content based on these segments. An investor interested in JVC apartments under AED 1 million shouldn’t receive emails about Palm Jumeirah luxury villas. Personalization improves email open rates, click-through rates, and conversion rates dramatically.

Conversion rate optimization (CRO) is continuous testing, not one-time fixes. For that real estate client, we ran A/B tests on:

- Hero images (lifestyle photos vs property exterior shots)

- Lead form length (3 fields vs 5 fields vs 7 fields)

- Call-to-action copy (“Schedule Viewing” vs “Book Tour” vs “See This Property”)

- Virtual tour placement (above fold vs mid-page)

- Trust signal positioning (developer logos, RERA badge, testimonials)

Small improvements compound. A 0.5% conversion rate increase on 40,000 monthly visitors means 200 additional leads per month. At a 5% close rate, that’s 10 additional property sales. In Dubai’s market, that’s millions of dirhams in commission.

Step 4: Strategic Paid Advertising for Dubai Property Marketing

Organic SEO builds long-term assets, but paid advertising accelerates results while SEO gains momentum. The key is integration—not treating paid ads as a separate channel.

Google Ads for high-intent searches captures buyers actively looking for specific properties. Someone searching “buy villa Palm Jumeirah” has strong purchase intent and converts at much higher rates than someone researching “Dubai property market trends.”

Your Google Ads campaign structure should mirror Dubai’s property market segments:

Campaign 1: Ready Properties – High Intent

- Keywords: “buy apartment Dubai Marina,” “villa for sale Arabian Ranches,” “townhouse Dubai Hills Estate.”

- Landing pages: Property-specific pages with immediate booking CTAs

- Budget: 40% of the total paid advertising budget

- Expected conversion: 2-3% (higher intent = higher conversion)

Campaign 2: Off-Plan Properties – Mid Intent

- Keywords: “DAMAC off-plan payment plan,” “Emaar new projects Dubai,” “off-plan apartments JVC”

- Landing pages: Development-specific pages with virtual tours

- Budget: 35% of total paid advertising budget

- Expected conversion: 1.5-2% (longer consideration period)

Campaign 3: Investment Properties – Qualified Intent

- Keywords: “Dubai property investment ROI,” “rental yield Dubai Marina,” “Golden Visa property requirements”

- Landing pages: Investment analysis pages with calculators

- Budget: 25% of total paid advertising budget

- Expected conversion: 1-2% (high-value but longer sales cycles)

Geographic targeting makes or breaks Dubai property campaigns. You’re not just targeting “Dubai”—you’re targeting specific international markets where your ideal buyers live.

For luxury properties, target high-net-worth individuals in Moscow, London, Paris, and GCC capitals like Riyadh and Doha. For mid-market properties, expand to Eastern European cities, Indian metros like Mumbai and Bangalore, and Pakistani markets like Karachi and Lahore.

Meta Ads (Facebook and Instagram) work differently than Google Ads. Instead of capturing existing demand, Meta Ads create demand through targeted brand awareness and lifestyle marketing.

Your Meta Ads strategy should focus on:

- Carousel ads showcasing multiple property images

- Video ads featuring virtual property tours

- Retargeting campaigns for website visitors who didn’t convert

- Lead generation campaigns with instant forms (no leaving Facebook)

- Lookalike audiences based on existing client databases

Budget allocation across platforms depends on your specific goals, but after managing AED 45,000+ monthly advertising budgets for Dubai real estate clients, I’ve found this split works well:

- Google Ads: 55% (capturing high-intent searches)

- Meta Ads: 30% (brand awareness and retargeting)

- LinkedIn Ads: 10% (for high-value commercial properties or investor targeting)

- Reserve: 5% (testing new platforms or tactics)

Cost-per-lead optimization is continuous work. When I reduced advertising costs by 40% for that real estate client, it wasn’t one magic trick—it was systematic testing and refinement:

- Negative keyword lists to prevent wasting budget on irrelevant searches

- Quality Score improvements through ad-to-landing-page relevance

- Bid adjustments by device, location, and time of day

- Ad copy testing (emphasizing payment plans vs ROI vs lifestyle benefits)

- Landing page conversion optimization

- Audience exclusions (removing existing clients, unqualified leads)

Developer marketing versus agency marketing requires different approaches. Developers sell their own projects exclusively and can offer better prices, payment plans, and inventory access. Agencies represent multiple developers and compete on service, market knowledge, and buyer relationship management.

If you’re a developer, your paid ads should emphasize:

- Direct-from-developer pricing benefits

- Exclusive payment plans not available through agents

- Developer track record and completed projects

- Immediate inventory access and unit selection

- Construction progress updates and completion guarantees

If you’re an agency, your paid ads should emphasize:

- Unbiased comparisons across multiple developers

- Market expertise and neighborhood knowledge

- Buyer protection and representation

- Access to off-market properties

- Full-service support through the purchase process

The integrated SEO + paid ads approach is why that client hit 44,800 monthly visits in six months. Organic traffic grew from 50 to approximately 22,000 monthly visits through technical SEO, content marketing, and topical authority building. Paid advertising contributed the remaining 22,800 visits through strategic Google and Meta campaigns.

But here’s the key: those two traffic sources reinforced each other. Paid ads generated immediate data on which keywords, property types, and messaging converted best. We used that data to inform organic content strategy. Organic content educated buyers and built trust, making paid ad retargeting campaigns far more effective. Landing pages optimized for paid ads also ranked organically for related searches.

Everything worked together. That’s the only way to achieve that kind of growth in Dubai’s competitive property market.

Step 5: Luxury Property Positioning and High-Net-Worth Targeting

Dubai’s luxury property market operates under completely different dynamics than mid-market residential sales. Villas increased 29% year-over-year through May 2025, vastly outpacing apartment growth of 20%. Dubai’s freehold villas now trade 66% above their 2014 peak and 175% higher than post-pandemic levels.

Prime areas like Palm Jumeirah saw villa prices climb 40% annually, Emirates Hills and The Meadows both increased 27%, and Jumeirah Islands jumped 41%. These aren’t average homebuyers—they’re ultra-high-net-worth individuals (UHNWI) making multi-million dirham purchases, often sight-unseen from international locations.

Marketing luxury properties requires sophisticated positioning that goes far beyond “beautiful villa for sale.” UHNWI buyers don’t search Google for “luxury villa Dubai”—they work through wealth managers, international real estate networks, and personal referrals.

Your luxury property strategy needs:

Content marketing that demonstrates market expertise. Write in-depth analyses of prime location price trends, architectural design philosophies in high-end developments, lifestyle comparisons between Emirates Hills versus Palm Jumeirah, and investment case studies for UHNWI portfolios. This content isn’t designed to rank for keywords—it’s designed to establish authority when shared in wealth management circles.

Virtual staging and professional photography at the highest level. High-quality photos increase perceived property value for 83% of buyers, and professionally staged homes sell 32% faster. For luxury properties, “high-quality” means architectural photography with professional lighting, drone footage showcasing location and views, 3D Matterport tours with dollhouse mode, and lifestyle photos showing the property in use (outdoor entertainment areas, home offices, chef’s kitchens).

Golden Visa promotion as a value-add benefit. AED 2 million+ property purchases qualify for UAE Golden Visa 10-year residency, and this matters enormously to international buyers. Many UHNWI buyers aren’t primarily seeking a residence—they’re securing long-term UAE residency for family security, tax optimization, and lifestyle access.

Your luxury property marketing should explicitly mention Golden Visa eligibility, explain the application process, and highlight the lifestyle benefits of UAE residency (safety, world-class infrastructure, strategic location between Europe and Asia, tax advantages).

International wealth management partnerships open doors to UHNWI buyer networks. Partner with:

- Private banks serving high-net-worth clients (HSBC Private Banking, Emirates NBD Private Banking)

- International wealth management firms (UBS, Credit Suisse, Goldman Sachs PWM)

- Family office networks

- Immigration consultancies specializing in Golden Visa applications

- International real estate networks (Christie’s International Real Estate, Sotheby’s International Realty)

These partnerships provide warm introductions to qualified buyers already working with trusted advisors. A referral from a client’s wealth manager carries infinitely more weight than a Facebook ad.

Exclusivity and discretion matter more than volume for luxury property sales. Don’t blast luxury listings across mass-market property portals. Instead, create private viewing events, invite-only property showcases, and confidential deal structures for high-profile buyers who value privacy.

When marketing a AED 15 million Palm Jumeirah villa, your strategy shouldn’t look anything like marketing a AED 800,000 JVC apartment. Different buyers, different motivations, different sales processes, different marketing tactics entirely.

Building Topical Authority Through Strategic Content Marketing

53% of real estate website traffic comes from organic search, and 51% of that organic traffic converts into leads. Content marketing isn’t a nice-to-have—it’s the foundation of sustainable lead generation that doesn’t disappear when you pause ad campaigns.

But generic property content doesn’t rank in Dubai’s competitive market. “Dubai Real Estate Market Analysis” has been written 10,000 times by international agencies copying each other. You need to demonstrate actual Dubai market expertise through specific, data-driven, locally-informed content.

Neighborhood-specific content strategy separates serious players from content farms. Don’t write one generic “Best Places to Live in Dubai” article. Write detailed guides for:

- Jumeirah Village Circle (JVC): Mid-market families, amenities analysis, school proximity, rental yields, property appreciation trends 2020-2025

- Dubai Marina: Luxury waterfront living, lifestyle amenities, restaurant and retail analysis, investor demographics, short-term rental regulations

- Business Bay: Commercial and residential mix, corporate proximity benefits, metro connectivity, property price comparisons versus Downtown Dubai

- Downtown Dubai: Burj Khalifa proximity, tourist appeal, rental demand drivers, resale market liquidity analysis

Each neighborhood guide should include:

- Actual DLD transaction data for the area

- Property price trends by unit type (studios, 1BR, 2BR, villas)

- Amenities map (schools, metro, shopping, parks, hospitals)

- Rental yield calculations based on current market rates

- Developer activity and upcoming projects

- Buyer demographics and typical property uses (investment vs end-user)

Property investment guides targeting investors need specific ROI analysis, not vague promises. When I write content for real estate clients, I include:

- Historical price appreciation data by development

- Rental yield comparisons across Dubai neighborhoods

- Occupancy rate trends

- Exit strategy considerations (resale liquidity, buyer demand)

- Tax implications for different investor nationalities

- Golden Visa qualification requirements

- Financing options for international buyers

Dubai market data integration builds authority and trust. Reference Dubai Land Department statistics on transaction volumes, Deloitte’s Dubai Real Estate Predictions reports for market forecasts, and ValuStrat Price Index data for price trend analysis.

This isn’t filler content—it’s demonstrating that you understand Dubai’s market at a level international agencies can’t match. You’re not regurgitating generic real estate advice from American websites. You’re providing Dubai-specific insights backed by local data sources.

Video content strategy is exploding in importance. 78% of people watch online videos weekly, and 91% of consumers prefer video content over other formats. For real estate specifically, video content drives 1,200% more social media shares than text and image posts combined.

Your video content should include:

- Property tours: Professional walkthroughs of featured listings

- Neighborhood videos: Area highlights showing lifestyle, amenities, and community features

- Market update videos: Monthly Dubai real estate market analysis

- Developer interviews: Showcasing new projects and payment plans

- Buyer education: “How to Buy Property in Dubai as an Expat” series

- Investment analysis: ROI breakdowns for specific developments

Social media for real estate isn’t about posting every listing. 82% of real estate businesses use social media, and 92% of U.S. realtors use Facebook for lead generation. But effective social media provides value beyond property advertisements.

Share Dubai market insights, neighborhood lifestyle content, property investment education, client success stories (with permission), behind-the-scenes content showing the property buying process, and Dubai living guides for newcomers.

Email marketing remains one of real estate’s highest-ROI channels despite being underutilized. Email marketing delivers 3,600% ROI and converts 40% better than social media for property leads. Since 2018, real estate email open rates increased 32% and click-through rates jumped 54%.

Your email strategy should include:

- Welcome sequence: Automated series introducing your agency, Dubai market expertise, and available properties

- Weekly market updates: Curated new listings, price trends, and market news

- Neighborhood spotlights: Monthly deep dives into specific Dubai areas

- Investment opportunities: Off-plan launches, developer specials, and limited-time offers

- Buyer education series: Multi-part courses on the property buying process, financing, and RERA regulations

Segment aggressively by buyer type, budget range, property preferences, and purchase timeline. An investor looking for rental properties shouldn’t receive the same emails as a family searching for their primary residence.

Staying RERA-Compliant While Marketing Aggressively

The Real Estate Regulatory Agency (RERA) doesn’t play around with advertising violations. AED 50,000 fines for non-compliant advertisements, and RERA issued warnings to 23 real estate brokerage firms in 2024 alone for regulatory breaches.

But here’s what most agencies don’t understand: RERA compliance isn’t a marketing limitation—it’s a trust-building opportunity. When buyers see your RERA permit numbers, Form A documentation, and QR code verification, they’re more confident you’re a legitimate, regulated operation.

RERA advertising regulations are governed by UAE Law No. 8 of 2007 and require all real estate companies to obtain advertising permits through the Trakheesi System before publishing any property advertisements—whether digital, print, or outdoor.

The advertising permit process requires:

- Valid RERA broker license

- Form A marketing agreement between property owner and broker

- Property title deed documentation

- Developer authorization letters for off-plan properties

- Verification that all advertised information is accurate

Form A requirements are mandatory for all property marketing. Form A is a written marketing agreement signed between property owners and real estate brokers authorizing the broker to represent and advertise the property. Without Form A, you legally cannot market that property.

For off-plan developments, Form A agreements come from developers, not individual unit owners. Make sure your agency has properly executed Form A documentation for every off-plan project you’re marketing. If RERA audits your advertisements and you can’t produce Form A authorization, you’ll face penalties.

Permit number display requirements mandate that every property advertisement—website listings, social media posts, print materials, outdoor signage—must include the RERA permit number clearly and visibly. This isn’t a suggestion; it’s a legal requirement.

On websites, include permit numbers on every property listing page. On social media posts, add permit numbers in the image or caption. On print advertisements, display permit numbers prominently. Make it easy for buyers to verify your authorization.

QR code mandates launched in 2024 require QR codes on all property advertisements linking to permit verification and detailed property information. When buyers scan the QR code, they should access RERA verification showing your permit is valid, property details are accurate, and all documentation is properly filed.

Implementing QR codes is straightforward:

- Generate QR codes through RERA’s Trakheesi System for each property

- Link QR codes to your RERA permit verification page

- Include QR codes on digital and print marketing materials

- Test QR codes regularly to ensure they’re functional

Penalties for non-compliance are serious. RERA can issue AED 50,000 fines per violation, suspend your broker license, and publish warnings that damage your agency’s reputation. In 2024, 23 firms received public warnings—that’s not the kind of publicity you want.

Beyond fines, non-compliance destroys trust. Buyers researching agents check RERA verification. If they find your advertisements violate regulations, they’ll work with compliant competitors instead.

Ethical advertising guidelines go beyond legal requirements. RERA requires property advertisements to be:

- Truthful: No misleading claims about property features, pricing, or availability

- Current: Listings must be updated promptly when properties sell or rent

- Transparent: All fees, commissions, and costs clearly disclosed

- Professional: No deceptive practices, pressure tactics, or false urgency claims

This means no:

- Advertising sold properties as available

- Showing photos of different properties than the one listed

- Hiding commission structures or additional fees

- Creating false urgency (“only 2 units left!” when 20 remain)

- Making guarantees that can’t be substantiated

How to market aggressively while staying compliant: Focus your competitive advantage on service quality, market expertise, and buyer results—not regulatory shortcuts.

Your marketing should emphasize:

- RERA license credentials and compliance record

- Client testimonials and successful transactions

- Dubai market expertise and local knowledge

- Transparent pricing and fee structures

- Professional service and ethical practices

- Comprehensive property information and documentation

When I grew that real estate client from 50 to 44,800 visits, we didn’t cut corners on RERA compliance. We made compliance a marketing asset. Every property listing featured prominent RERA permit numbers, Form A verification, and QR codes. We highlighted the agency’s perfect compliance record in our messaging.

Buyers appreciated the transparency. Instead of seeing compliance as bureaucracy, they saw it as the agency protecting their interests through proper regulation adherence.

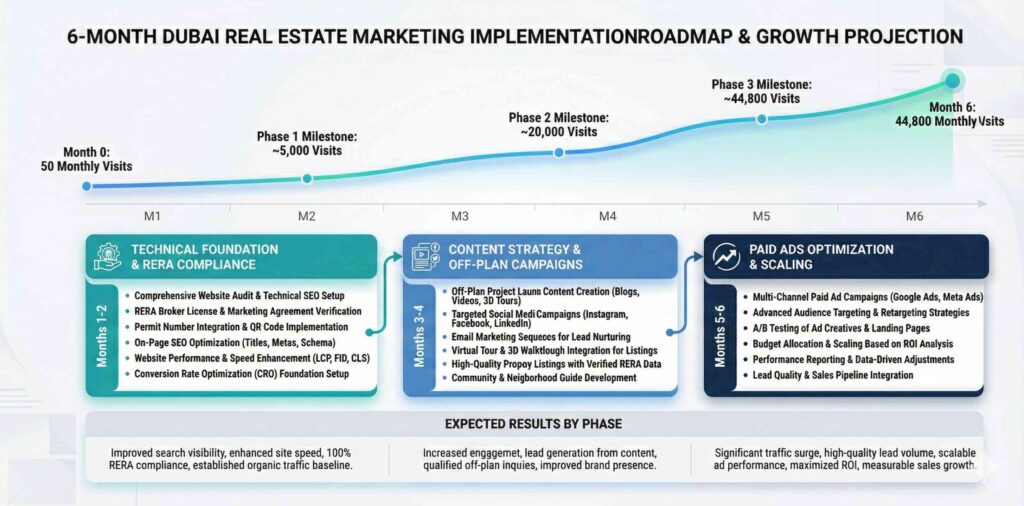

Your 6-Month Roadmap to Replicating the 50→44,800 Growth

This isn’t theoretical. Here’s the exact implementation roadmap I used to transform that Dubai real estate agency from invisible to dominant in six months.

Month 1-2: Technical Foundation and RERA Compliance

Week 1-2: Technical SEO audit and fixes

- Core Web Vitals optimization (target: LCP <2.5s, FID <100ms, CLS <0.1)

- Mobile performance improvements

- Schema markup implementation (Organization, LocalBusiness, RealEstateListing)

- Site architecture optimization

- Internal linking structure

Week 3-4: RERA compliance implementation

- Form A documentation for all listed properties

- RERA permit number integration on all pages

- QR code generation and implementation

- Advertising permit renewal and verification

- Legal marketing review

Week 5-6: Conversion infrastructure

- Landing page template creation (property listings, neighborhoods, developers)

- Lead capture form optimization

- WhatsApp Business API integration

- CRM setup and lead tracking systems

- Email marketing platform configuration

Week 7-8: Analytics and tracking

- Google Analytics 4 setup with enhanced ecommerce

- Conversion tracking implementation

- Call tracking for phone leads

- Lead source attribution modeling

- Dashboard creation for performance monitoring

Month 3-4: Content Strategy and Off-Plan Campaigns

Week 9-10: Content planning and creation

- Keyword research for Dubai neighborhoods and property types

- Content calendar development (blog posts, neighborhood guides, investment analysis)

- First 8 blog posts written and published

- Video content production begins (property tours, market updates)

Week 11-12: Off-plan property campaigns

- Off-plan inventory analysis and selection

- Developer partnership activation

- Off-plan landing pages created

- Virtual tour integration for pre-construction properties

- Payment plan calculators and tools

Week 13-14: Local SEO dominance

- Google Business Profile optimization

- Local citation building (Bayut, Property Finder, Dubizzle)

- Neighborhood-specific content publication

- Location pages for key Dubai areas

- Local backlink building

Week 15-16: Authority building

- Guest posting on Dubai business and lifestyle sites

- Developer partnership announcements

- Press releases for major listings or achievements

- Industry association participation

- Social proof accumulation (reviews, testimonials)

Month 5-6: Paid Ads Optimization and Scaling

Week 17-18: Google Ads launch

- Campaign structure implementation (ready, off-plan, investment)

- Keyword research and negative keyword lists

- Ad copy creation and testing

- Landing page assignment and optimization

- Initial budget allocation and bid management

Week 19-20: Meta Ads campaigns

- Audience research and segmentation

- Creative production (carousel ads, video ads, static images)

- Campaign setup (awareness, consideration, conversion)

- Retargeting pixel implementation

- Lookalike audience creation

Week 21-22: Campaign optimization

- A/B testing results analysis

- Budget reallocation based on performance

- Landing page conversion improvements

- Ad copy refinement

- Audience targeting adjustments

Week 23-24: Scaling and expansion

- Budget increases for winning campaigns

- Geographic expansion (international markets)

- New property type campaigns

- Seasonal promotions

- Performance reporting and forecasting

Budget Breakdown (Realistic for Dubai Market)

If replicating this in-house with a full-stack marketer:

- Salary: AED 15,000-20,000 monthly (experienced Dubai market specialist)

- Tools and software: AED 2,000-3,000 monthly (SEO tools, analytics, CRM, design software)

- Paid advertising budget: AED 20,000-40,000 monthly (depending on scale)

- Content production: AED 3,000-5,000 monthly (photography, video, copywriting support)

- Total: AED 40,000-68,000 monthly

Compare to traditional agency setup:

- SEO agency: AED 8,000-12,000

- Google Ads manager: AED 6,000-10,000

- Content agency: AED 4,000-6,000

- Web designer: AED 5,000-8,000

- CRO specialist: AED 4,000-7,000

- Paid advertising budget: AED 20,000-40,000

- Total: AED 47,000-83,000 monthly

The integrated approach costs less while delivering better results because everything works together instead of fighting for budget and attention.

Team Requirements

You have two options:

Option 1: Hire one full-stack digital marketer with Dubai real estate experience who can handle SEO, paid ads, web design, content strategy, and CRO. This person should understand RERA compliance, Dubai market dynamics, and property investor psychology.

Option 2: Work with a specialized freelancer or small agency (like me) who provides the integrated system without the overhead of hiring multiple agencies. You get the full-stack expertise at 60% lower cost than traditional agency setups.

Success Metrics to Track

Don’t just measure vanity metrics like traffic and impressions. Track metrics that directly impact revenue:

- Organic traffic growth (target: 300% increase in 6 months)

- Paid traffic volume and cost (target: 40% cost-per-click reduction through optimization)

- Total lead volume (target: 500+ monthly leads by month 6)

- Lead quality score (track conversion rates by lead source)

- Cost per qualified lead (target: under AED 200 for mid-market, under AED 500 for luxury)

- Lead-to-viewing conversion rate (target: 15%+)

- Viewing-to-offer conversion rate (target: 25%+)

- Average deal size (track by property type and buyer segment)

- Revenue generated from marketing efforts (ultimate success metric)

Expected Timeline for Results

Be realistic about SEO timelines. When I tell clients “6 months to see significant results,” I mean:

- Month 1-2: Technical improvements, some quick wins on low-competition keywords

- Month 3-4: Content starting to rank, traffic beginning to grow

- Month 5-6: Momentum building, rankings improving for competitive terms

- Month 7+: Compounding effects, traffic accelerating, authority established

Paid advertising delivers faster results but requires more capital. Expect:

- Week 1-2: Campaign setup, testing, initial data gathering

- Week 3-4: Optimization based on early performance

- Week 5-8: Scaling winning campaigns, eliminating losers

- Month 3+: Consistent lead flow, predictable cost-per-lead, positive ROI

The 50→44,800 visits didn’t happen overnight. It was a systematic implementation of the complete blueprint over six months. Month 1 showed minimal traffic growth. Month 3 showed acceleration. Month 6 hit the target through the compounding effects of SEO + paid ads + content + conversion optimization all working together.

Frequently Asked Questions

What is a real estate industry authority, and why does it matter for Dubai businesses?

Real estate industry authority means Google and potential buyers recognize your agency as a trusted expert in Dubai’s property market—not just another listing aggregator. It’s built through comprehensive content covering specific entities like DAMAC developments, Dubai Marina market dynamics, RERA compliance requirements, and off-plan investment structures.

Authority matters because Dubai’s real estate market is brutally competitive. When someone searches “Dubai property investment,” they see thousands of results. Google ranks agencies with demonstrated expertise higher than generic international firms copying each other’s content. Buyers trust agencies that show deep Dubai market knowledge over those regurgitating generic real estate advice.

Building authority requires covering hyponymic entities—specific concepts rather than general terms. Instead of writing “SEO tips for real estate,” write about Core Web Vitals optimization for property listing pages, schema markup for Dubai developments, and local SEO for Jumeirah Village Circle. This specificity proves expertise to both Google and buyers.

How much does a real estate industry authority typically cost in Dubai?

Traditional agency setups charge AED 27,000-43,000 monthly for fragmented services: a separate SEO agency, Google Ads manager, content writer, web designer, and CRO specialist. You’re paying for coordination overhead, not integrated strategy.

A full-stack digital marketer with Dubai real estate expertise costs AED 15,000-20,000 monthly in salary plus AED 2,000-3,000 in tools—total AED 17,000-23,000 monthly for the same (actually better) results. That’s 60% cost savings while eliminating the waste of five vendors working against each other.

ROI expectations: expect 3-6 months before seeing significant organic traffic growth. For that real estate client, I invested six months of integrated marketing before hitting 44,800 monthly visits. The investment paid back within three months through increased lead flow and property sales.

Budget allocation should prioritize technical SEO foundation first (months 1-2), content creation second (months 3-4), then paid advertising scaling (months 5-6) once you have conversion-optimized landing pages to send traffic to.

What are the main benefits of real estate industry authority for UAE companies?

Organic traffic generates 51% of real estate website traffic and converts at 3.2%—higher than paid search at 1.5%. When you rank organically for “off-plan apartments JVC” or “Dubai Marina property investment,” you’re capturing buyers actively searching for what you offer without paying per click.

Higher quality leads come from organic search because buyers found you through educational content, not aggressive retargeting ads. They’ve read your neighborhood guides, market analysis, and investment breakdowns. They’re pre-qualified and trust you before first contact.

Reduced paid advertising dependency means sustainable growth that doesn’t evaporate when budgets tighten. When I grew that client from 50 to 44,800 visits, roughly half came from organic search. Those organic visits cost nothing incremental—they’re the result of authority built through content and SEO.

Long-term asset building creates compounding returns. A blog post written today ranks for months or years, generating continuous traffic without ongoing costs. Paid ads stop working the moment you stop paying. Organic authority is an asset you own.

How long does it take to see results from real estate industry authority?

Realistic timeline: 3-6 months for significant movement. Anyone promising “first page rankings in 30 days” is either targeting zero-competition keywords or lying.

For that real estate client who hit 44,800 monthly visits in six months, the growth curve looked like:

Month 1: 120 visits (technical fixes, some quick wins)

Month 2: 450 visits (content beginning to index)

Month 3: 2,100 visits (momentum building)

Month 4: 8,500 visits (rankings improving for competitive terms)

Month 5: 22,000 visits (compounding effects accelerating)

Month 6: 44,800 visits (organic + paid integrated strategy hitting full stride)

Early wins in months 1-2 come from low-competition, specific searches. “DAMAC Lagoons 4-bedroom townhouse payment plan” ranks faster than “Dubai real estate.” Target these quick wins while building authority for competitive terms.

Long-term growth accelerates as topical authority strengthens. Your 100th blog post ranks faster than your first because Google recognizes your site as a real estate authority. Content published in month 6 starts ranking in weeks instead of months.

Why instant results are unrealistic: Google needs time to crawl your content, understand your topical coverage, and build trust in your site. Competitors with years of authority won’t disappear overnight. Sustainable growth requires patience and systematic implementation.

What are common mistakes businesses make with real estate industry authority?

Hiring separate vendors instead of an integrated approach wastes money and fragments strategy. When your SEO agency doesn’t coordinate with your Google Ads manager, they optimize for different goals and duplicate efforts. Your content writer creates blog posts the web designer buries three clicks deep where nobody finds them.

Ignoring RERA compliance destroys trust and risks AED 50,000 fines. International agencies don’t understand Form A requirements, permit number mandates, or QR code regulations. They create beautiful campaigns that violate Dubai’s advertising laws.

Generic international strategies don’t work in Dubai’s unique market. What ranks in New York or London fails here because Dubai’s buyer demographics (international investors seeking Golden Visas), property types (off-plan dominance), and regulations (RERA compliance) are completely different.

Neglecting off-plan property marketing means missing Dubai’s dominant segment. Approximately 182,000 units are delivering in 2025-2026, and flexible payment plans make off-plan the entry point for most buyers. If your strategy focuses only on ready properties, you’re ignoring the majority of the market.

Poor conversion funnel optimization wastes traffic. Growing from 50 to 44,800 visits means nothing if your landing pages convert at 0.5% instead of the industry average 4.7%. Invest in conversion optimization—better forms, faster load times, clearer calls-to-action, trust signals, and WhatsApp integration.

Conclusion

After 6+ years managing digital marketing campaigns exclusively in Dubai, I’ve learned that real estate marketing success isn’t about brilliant tactics—it’s about eliminating waste.

Most Dubai property agencies bleed AED 30,000+ monthly on fragmented vendor relationships where nobody coordinates, strategy conflicts, and mediocre results barely justify the expense. They hire SEO agencies that ignore RERA compliance, Google Ads managers who don’t understand Dubai’s property investor psychology, and web designers who build slow, non-converting landing pages.

When I transformed that real estate client from 50 to 44,800 monthly visits in six months, the breakthrough wasn’t one magic trick. It was replacing five uncoordinated vendors with one integrated system where SEO informed paid ads, paid ads revealed content gaps, content attracted organic traffic, and everything converted better because it all worked together.

Dubai’s real estate market is on fire. Dh525.87 billion in property sales across 168,540 transactions in just 290 days of 2025. Residential prices up 20%, population growing 5% annually, and 182,000 new units delivering over the next two years. The opportunity is massive.

But opportunity means nothing without marketing that captures it. Your competitors have nine-figure budgets and international agency relationships. You need an advantage—and that advantage is the integrated approach that replaces fragmented agencies at 60% lower cost while delivering better results.

This isn’t theoretical. It’s the exact blueprint I used to generate 180% more qualified healthcare leads for a medical recruitment client, achieve #1 Google ranking for “Damac Island Investment,” and grow real estate traffic from 50 to 44,800 monthly visits in six months.

The question isn’t whether Dubai’s real estate market offers opportunities. The question is whether you’re ready to stop coordinating five vendors who work against each other and start building an integrated marketing system that actually works.

Want to replicate this 50→44,800 traffic growth for your Dubai real estate agency?

Get your free consultation at muhammadzubair.me. I’ll analyze your current setup and show you exactly where you’re wasting money.

Or call me directly: +971 50 136 1813

Let’s build your integrated marketing system.