I generated 180% more qualified healthcare professional leads in 4 months for a Dubai medical recruitment agency—while staying completely DHA-compliant. The campaign cost 45% less per application than their previous efforts, delivered over 500 qualified leads, and helped them fill 12 critical positions in 3 months.

That’s the power of healthcare marketing done right in the GCC region.

Most healthcare businesses in Dubai approach marketing with two opposing problems. Either they avoid marketing altogether because they’re terrified of violating DHA regulations and facing AED 100,000+ fines, or they copy international healthcare campaigns without understanding that what works in New York or London will get you penalized in Business Bay. Both approaches leave money on the table and patients going to your competitors.

After managing healthcare marketing campaigns across Dubai and the broader GCC region for over six years, I’ve learned that success requires simultaneously mastering two critical elements: strict regulatory compliance and aggressive patient acquisition strategies. You can’t choose one or the other. Healthcare marketing in markets like Dubai, Abu Dhabi, Riyadh, and Doha demands both.

This guide covers everything you need to build a DHA-compliant healthcare marketing system that actually generates measurable results. You’ll learn the exact regulatory framework governing medical advertising across the GCC, proven patient acquisition strategies that work in Dubai’s competitive market, medical recruitment marketing tactics that generated that 180% lead increase, telemedicine marketing in regulated environments, and how to track real ROI instead of vanity metrics.

Whether you run a private clinic in Dubai Marina, manage a medical recruitment agency, operate a telemedicine platform, or handle marketing for a healthcare group with multiple locations across the UAE, the principles and strategies in this guide will help you grow while staying compliant.

🏥 Healthcare Marketing ROI Calculator

Discover Your Potential Results with DHA-Compliant Marketing in Dubai

Based on Real 180% Lead Increase ResultsInteractive Patient Acquisition Funnel

Click each stage to see detailed metrics and strategies used in the 180% lead increase case study

At this stage, we attract healthcare professionals and patients through targeted advertising and SEO-optimized content.

Prospects engage with content, download resources, and explore services. DHA-compliant messaging builds trust.

Prospects are ready to take action. They fill forms, request consultations, or download detailed resources.

Qualified leads convert to scheduled appointments or consultations. Follow-up systems ensure high show rates.

Email automation, personalized follow-ups, and loyalty programs turn one-time patients into repeat clients.

Calculate Your Potential ROI

Enter your current metrics to see how the 180% methodology could transform your results

🎯 Your Potential Results with 180% Methodology

💡 These projections are based on the proven 180% methodology used for First Medical Consultancy

DHA-Compliant Marketing Strategies

Click each card to learn about essential healthcare marketing components in Dubai

DHA Compliance First

Ensure all marketing follows Dubai Health Authority guidelines. Avoid AED 100K+ penalties.

Local SEO Mastery

Dominate Google searches for Dubai healthcare services with GCC-optimized strategies.

Patient Acquisition Funnels

Convert 25% of qualified leads to appointments with proven funnel systems.

Medical Recruitment

Attract top healthcare talent with 180% more qualified applications.

ROI Tracking Systems

Measure what matters: CPA, LTV, conversions, and real Dubai healthcare metrics.

Telemedicine Marketing

Promote virtual care services with DHA-compliant digital health strategies.

🚀 Ready to Transform Your Healthcare Marketing?

Get a free consultation and discover how the 180% methodology can work for your Dubai healthcare business

Free Consultation on WhatsApp✓ No commitment required ✓ Get personalized strategy ✓ Response within 2 hours

Why DHA Compliance Isn’t Optional (It’s Your Marketing Foundation)

Healthcare marketing in the GCC operates under one of the world’s strictest regulatory frameworks. Unlike other industries where you can test aggressive marketing tactics and adjust if they don’t work, healthcare advertising violations can result in immediate license suspension and fines between AED 100,000 and 200,000. That’s not a theoretical risk—it’s enforced reality in Dubai and across the Emirates.

The Three-Tier Regulatory Structure in GCC

Understanding who regulates what is essential before launching any healthcare marketing campaign. The GCC operates on a multi-layered regulatory system where federal, emirate-level, and country-specific authorities all maintain oversight.

At the federal level in the UAE, the Ministry of Health and Prevention (MOHAP) issues marketing authorizations for medical products and licenses all pharmaceutical advertising before it can appear anywhere. No exceptions. If you’re promoting a medical product, treatment protocol, or pharmaceutical service, MOHAP approval isn’t optional—it’s the first step.

The process requires submitting your advertising materials electronically through their portal, including your marketing authorization, example advertisements, desired platforms, and campaign duration. Approval timelines vary, but expect 2-4 weeks for standard campaigns.

At the emirate level, you’re dealing with specific health authorities that implement additional regulations within their jurisdictions. In Dubai, the Dubai Health Authority (DHA) enforces strict guidelines on medical advertisement content, particularly on social media and digital platforms.

The DHA’s “Guidelines for Medical Advertisement Content on Social Media” specifically prohibit misleading or deceptive content, unauthorized use of government logos, unethical marketing that exploits patient vulnerabilities, comparative advertising without peer-reviewed evidence, and content that breaches UAE cultural norms or Islamic teachings.

Abu Dhabi operates under the Department of Health (DOH) with parallel but slightly different requirements. Sharjah has its own Health Authority with additional considerations.

If you’re marketing healthcare services across Saudi Arabia as part of a broader GCC strategy, you’re navigating Vision 2030 healthcare regulations that emphasize preventive care, digital health integration, and strict medical tourism advertising standards.

The Kingdom is investing billions in healthcare infrastructure and expects the sector to grow at 8.8% annually through 2029, but that growth comes with increased regulatory scrutiny.

When I develop healthcare marketing campaigns for clients operating across multiple GCC markets, we create compliance matrices that map each piece of content against federal, emirate, and country-specific regulations. It’s tedious work, but it’s the only way to ensure a campaign approved in Dubai doesn’t violate regulations in Riyadh or Doha.

DHA Social Media Advertising Guidelines (2026)

Social media is where most healthcare marketing violations occur, primarily because marketers treat Facebook, Instagram, and LinkedIn the same way they would for a restaurant or retail brand. That’s an expensive mistake in Dubai’s healthcare market.

DHA Compliance Quick Reference:

| ✅ PERMITTED | ❌ PROHIBITED |

|---|---|

| Factual service descriptions | Misleading outcome claims |

| Physician credentials & qualifications | Unauthorized government logos |

| Educational health content | Fear-based marketing tactics |

| Patient testimonials (with consent) | Unsubstantiated comparisons |

| Preventive care information | Before/after photos (without consent) |

| Facility capabilities & technology | Guaranteed results or cure claims |

| Insurance acceptance information | Cultural/religious violations |

The DHA explicitly prohibits misleading content, including any advertisement that makes exaggerated, unsubstantiated, or false claims about treatment outcomes, benefits, or efficacy.

A clinic promoting a weight loss treatment that guarantees “10 kilograms lost in one month with no dietary or exercise changes” violates DHA standards and creates liability under enforcement. The claim sets unrealistic patient expectations and misrepresents the treatment’s actual capabilities.

Using official logos or symbols without explicit written permission is strictly prohibited. This includes the DHA logo itself, MOHAP insignia, or any government health authority branding.

I’ve seen clinics use the DHA logo in social media posts to imply government endorsement without obtaining prior approval. The result was a formal warning, mandatory content removal, and an AED 50,000 fine for the repeated violation.

Unethical content that exploits patient trust, induces unnecessary fear, or creates artificial demand for unnecessary treatments is prohibited across all platforms. An advertisement stating “If you don’t get this treatment, you might be at risk of serious health issues” uses fear-based tactics to coerce patients into purchasing services.

This violates medical ethics standards and DHA marketing guidelines regardless of whether the underlying medical claim is technically accurate.

Comparative advertising is only permitted if comparisons are based on credible, peer-reviewed evidence. A dentist advertising that their whitening procedure is “better and safer than other dentists in the area” without scientific evidence backing that specific claim crosses into prohibited territory.

If you’re going to make comparative statements in healthcare marketing, you need published research, clinical trial data, or peer-reviewed studies supporting every element of the comparison.

Cultural compliance is non-negotiable in the UAE market. Content that breaches UAE cultural norms, contradicts Islamic teachings, or includes nudity, profanity, or material against public interest is strictly prohibited.

This extends to image selection, video content, testimonial presentation, and even humor in healthcare marketing. What’s acceptable in Western markets often doesn’t translate to Dubai’s cultural context.

The practical reality: I review every piece of social media content my healthcare clients produce before publication. A single compliant post takes 3-5x longer to create than non-healthcare content because of the verification, source-checking, and legal review process.

But that extra time prevents violations that could cost hundreds of thousands in fines or—worse—damage patient trust that takes years to rebuild.

Medical Product Marketing Authorization

If you’re promoting any medical product, pharmaceutical, device, or treatment protocol in the UAE, you need MOHAP marketing authorization before a single advertisement runs.

MOHAP Authorization Workflow:

- Obtain Market Authorisation from MOHAP for the product itself (no product can be advertised without this foundational approval)

- Register MOHAP Account and upload required documentation:

- Marketing Authorisation certificate

- Example product advertisements

- Desired advertising locations and platforms

- Media platform specifications

- Campaign duration approval request

- Emirate-Level Review (case-by-case):

- DHA review for Dubai campaigns

- DOH review for Abu Dhabi campaigns

- SHA review for Sharjah campaigns

- Approval Timeline:

- Standard pharmaceutical advertising: 3-4 weeks

- Complex medical devices: 6-8 weeks

- Digital-only campaigns: potentially faster processing

Timeline expectations vary significantly. Standard pharmaceutical advertising approval takes 3-4 weeks from complete application submission. Complex medical device marketing can extend to 6-8 weeks, depending on the device classification and proposed marketing claims.

Digital-only campaigns sometimes receive faster processing than multi-channel campaigns because the review scope is more limited.

Non-compliance carries severe penalties. Under the 2019 Pharmacy Law, violations are criminal offenses punishable by imprisonment or fines levied by MOHAP, with fine amounts scaling based on violation severity and frequency.

The UAE Media Council can impose fines between AED 100,000 and 200,000 for publishing advertisements online and on social media without proper authorization. For perspective, that’s the equivalent of 3-6 months of marketing budget for a mid-sized Dubai clinic—gone in a single violation.

When I managed a campaign for a medical aesthetics clinic launching a new treatment in Dubai, the authorization process took 5 weeks from initial application to final approval.

We built that timeline into our launch calendar from day one, scheduled our campaign kickoff for week six, and used the waiting period to develop compliant creative assets, train staff on regulatory messaging requirements, and build our landing pages with pre-approved copy.

The campaign launched on schedule because we treated compliance as a project milestone, not an afterthought.

Why GCC Is the World’s Fastest-Growing Healthcare Market

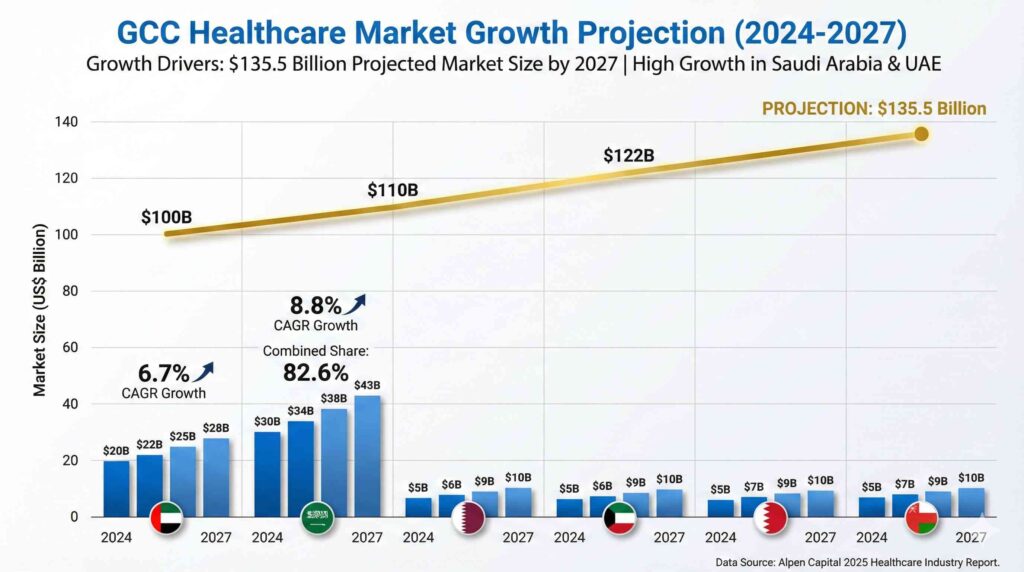

The numbers tell a compelling story. Healthcare spending in the GCC region is projected to reach $135.5 billion by 2027, driven by demographic shifts, government investment in healthcare infrastructure, and rapid adoption of digital health technologies.

For healthcare marketers, this represents an unprecedented opportunity—if you understand the market dynamics driving that growth.

Market Size & Growth Projections

The UAE’s healthcare market is expanding at a 6.7% compound annual growth rate from 2024 through 2029, while Saudi Arabia leads the region at 8.8% annual growth fueled by Vision 2030 healthcare initiatives.

Saudi Arabia and the UAE combined will account for 82.6% of regional healthcare expenditure by 2029, creating a concentrated market for healthcare services and the marketing strategies that support them.

Digital healthcare specifically is experiencing explosive growth. The GCC Digital Healthcare Market is expected to grow at a 21.48% CAGR through 2035, reaching $45.44 billion by the mid-2030s.

Telemedicine, mobile health applications, healthcare analytics platforms, and remote patient monitoring systems are shifting from emerging technologies to standard care delivery models.

For healthcare marketers, this means digital channels aren’t just another marketing option—they’re where your patients increasingly live.

The region requires an estimated 12,317 new hospital beds between 2024 and 2029, with Saudi Arabia accounting for 69% of that expansion. Each new facility represents opportunities for patient acquisition marketing, medical professional recruitment campaigns, and healthcare service promotion across specialized treatment areas.

Health insurance penetration continues expanding as GCC governments mandate coverage. The GCC health insurance market is projected to reach $29.2 billion by 2033, growing at 5.3% annually. Dubai, Abu Dhabi, and Saudi Arabia have already implemented mandatory health insurance requirements.

Kuwait, Bahrain, and Oman are in various stages of introducing similar mandates. For healthcare marketers, this creates a population that’s financially capable of accessing care and actively searching for healthcare providers covered by their insurance plans.

Key Trends Driving Healthcare Demand

The GCC population over 50 years old is increasing from 12.7% in 2024 to 13.8% in 2029, creating surging demand for specialized healthcare services, including cardiology, orthopedics, oncology, and chronic disease management.

This demographic shift directly impacts which medical specialties should invest in patient acquisition marketing and which service lines generate the highest patient lifetime value.

Medical tourism represents a strategic priority across the region. Dubai Health Authority actively promotes Dubai as a medical tourism destination through the Dubai Medical Tourism initiative. Abu Dhabi’s Cleveland Clinic and other world-class facilities position the UAE as a regional healthcare hub.

Saudi Arabia’s Vision 2030 includes explicit medical tourism targets. For healthcare marketers, this means campaigns can target both residents and international patients seeking specialized treatments, cosmetic procedures, fertility services, and advanced diagnostics not available in their home markets.

Telemedicine adoption accelerated dramatically post-COVID and shows no signs of reverting. The Seha Virtual Hospital in Saudi Arabia now connects over 170 hospitals, enabling remote specialist consultations for patients in underserved areas.

Platforms like Altibbi in the UAE have facilitated over 5 million telehealth consultations. Digital health platforms are transitioning from pandemic necessities to permanent care delivery channels, requiring healthcare marketers to develop virtual care promotion strategies that comply with telemedicine-specific regulations.

Artificial intelligence in healthcare diagnostics, robotic surgery systems, genomic medicine programs, and precision treatment protocols are driving healthcare innovation investments. The UAE appointed a Minister of AI in 2023, signaling governmental commitment to technology integration.

Qatar’s Genome Program is building comprehensive genetic databases supporting personalized medicine. For healthcare marketers promoting facilities with advanced capabilities, these technological differentiators become key messaging points that distinguish your facility from traditional providers.

Competitive Landscape for Healthcare Marketing

The GCC healthcare sector faces a critical workforce challenge: high dependence on foreign healthcare professionals across all specialties creates ongoing recruitment needs and talent retention pressure.

This shortage creates marketing opportunities for medical recruitment agencies, healthcare staffing firms, and facilities positioning themselves as preferred employers for international medical professionals seeking GCC licensing.

A gap in specialized care units, particularly in tertiary care segments, contributes to outbound medical tourism where GCC residents travel internationally for complex treatments. Healthcare facilities that can credibly market specialized capabilities—backed by international accreditations, experienced specialists, and advanced technology—can capture patients who would otherwise seek care abroad.

Non-communicable diseases, including diabetes, cardiovascular conditions, and obesity are rising across the region. The UAE recorded a 75% increase in diabetes cases over the past decade.

These chronic conditions require ongoing care management, creating patient lifetime value that extends beyond single treatment episodes. Healthcare marketing that addresses chronic disease management, preventive care, and long-term health optimization aligns with both patient needs and government health initiatives.

The shift toward privatization through public-private partnership models is accelerating. Governments are actively promoting private sector participation to reduce cost burdens and increase care quality standards.

For private healthcare providers and investors, this creates opportunities to market services that complement government healthcare offerings while appealing to patients seeking shorter wait times, enhanced amenities, and specialized treatment access.

When I analyze the GCC healthcare market for clients deciding where to allocate marketing budgets, I’m looking at growth rates, demographic trends, competitive density by specialty, regulatory environments, and patient acquisition cost benchmarks.

A cardiology practice in Dubai faces different marketing economics than a cosmetic dermatology clinic in Riyadh, even though both are healthcare providers in fast-growing GCC markets.

How I Would Build a Patient Acquisition System for Dubai Healthcare

Patient acquisition in Dubai’s healthcare market requires understanding both universal healthcare marketing principles and specific dynamics unique to the GCC region.

After managing campaigns that generated thousands of patient inquiries across clinics, hospitals, and specialized treatment centers, I can tell you the biggest mistake healthcare marketers make: applying generic patient acquisition tactics without adapting them to Dubai’s regulatory environment, cultural context, and competitive landscape.

The Full-Funnel Patient Journey in GCC

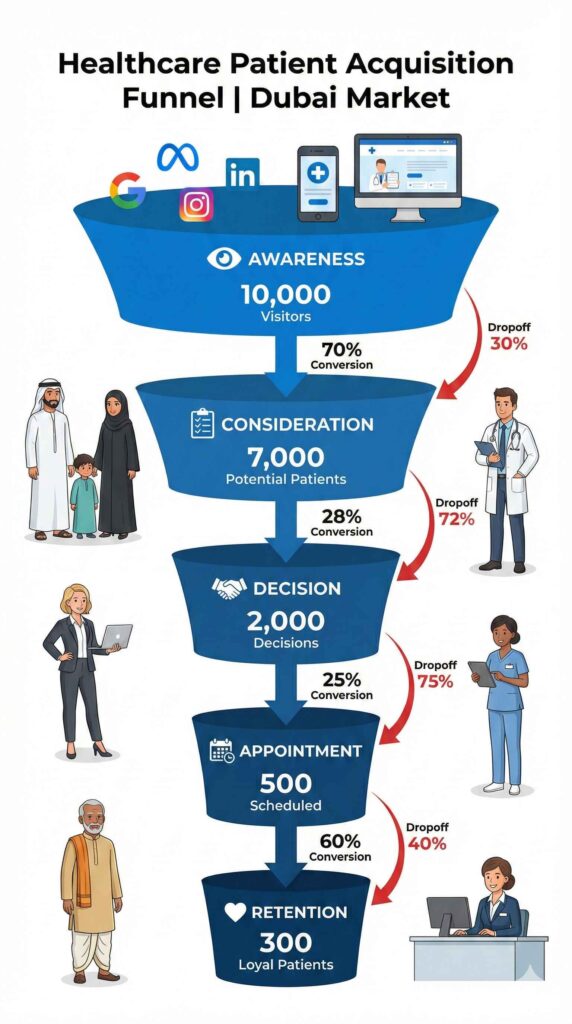

Healthcare decision-making in the UAE follows distinct patterns that differ from Western markets. Patients in Dubai typically require 15 touchpoints across multiple channels before booking their first appointment. That’s higher than the 8-10 touchpoints common in less regulated or less culturally complex markets.

The Five-Stage Patient Journey:

1. Awareness Stage – Patient discovers healthcare providers through:

- Google searches for symptoms or conditions

- Social media content from healthcare providers

- Referrals from existing patients or primary care physicians

- Insurance provider directories and covered facilities

- Physical presence in high-traffic Dubai locations

2. Consideration Stage – Patient evaluates based on:

- DHA licensing and international accreditations

- Specialist qualifications and language capabilities

- Insurance acceptance and transparent pricing

- Facility location and appointment availability

- Online reviews and patient testimonials

3. Decision Stage – Often involves:

- Family consultation (particularly for significant procedures)

- Comparison of 3-5 different providers

- Insurance verification and cost confirmation

- Review of physician credentials and facility capabilities

- Reading multiple patient reviews and success stories

4. Appointment Stage – Conversion happens when:

- The online booking system is easy to use

- Phone consultation provides clear information

- Appointment availability matches patient’s schedule

- Insurance coverage is confirmed upfront

- The initial consultation process is clearly explained

5. Retention Stage – Long-term value built through:

- Excellent patient care experience

- Follow-up appointment reminders

- Preventive care communications

- Educational health content delivery

- Loyalty programs and family care coordination

Each discovery channel requires different messaging, compliance considerations, and conversion paths.

Trust-building is especially critical in the UAE healthcare market, where 60% of patients research providers online before making contact, but simultaneously value personal referrals and established reputations highly.

Your digital presence must reinforce trust signals, including complete physician bios with qualifications and photos, transparent treatment information without misleading claims, actual facility images showing modern equipment and clean environments, verified patient reviews and testimonials, and clear pricing information where permissible.

When I develop healthcare marketing campaigns for clients operating across multiple GCC markets, we create compliance matrices that map each piece of content against federal, emirate, and country-specific regulations.

Your profile must include your DHA license number prominently displayed, accurate NAP information consistent across all platforms, complete service listings using Dubai-specific terminology, regular posts about health topics and facility updates, and verified patient reviews with appropriate responses.

I’ve helped healthcare clients achieve top-3 local pack rankings in competitive Dubai submarkets through systematic GBP optimization combined with location-specific content and citation building.

Dubai-specific keywords differ significantly from generic medical search terms. Patients search for “dermatologist Dubai Marina” rather than just “dermatologist,” “DHA approved clinic” instead of generic facility names, and “pediatrician Business Bay” rather than broader location terms.

Your keyword strategy must include neighborhood-level targeting because Dubai residents strongly prefer convenient locations. A clinic in Jumeirah won’t easily attract patients from International City, regardless of specialization.

Arabic language considerations can’t be ignored despite English being widely spoken in Dubai business environments. Approximately 55% of UAE residents are native Arabic speakers, and health-related searches often happen in Arabic even among multilingual populations.

Healthcare websites serving Dubai markets should offer complete Arabic versions, not just translated snippets. Google evaluates language consistency and quality when ranking local results, and poor machine translations actively hurt your local SEO performance.

Geographic targeting extends beyond city-level optimization. Dubai’s distinct communities, including DIFC and Downtown Dubai for expatriate professionals, Dubai Marina and JBR for international residents, Jumeirah and Arabian Ranches for established families, International City and Discovery Gardens for diverse demographics, and Dubai Silicon Oasis for tech professionals, each have different healthcare needs, price sensitivities, and language preferences.

Location-specific landing pages that speak to each community’s demographics consistently outperform generic citywide pages.

Google Ads & Meta Ads for Healthcare (DHA-Compliant)

Paid advertising for healthcare in Dubai requires understanding what the DHA permits versus what triggers violations.

You can advertise medical services and specialties including “cardiology consultations,” “pediatric care,” and “orthopedic surgery,” specific procedures and treatments like “dental implants,” “LASIK surgery,” and “physiotherapy sessions,” facility capabilities such as “24-hour emergency care,” “advanced diagnostic imaging,” and “multilingual medical staff,” and preventive health services including “annual health screenings,” “vaccination programs,” and “nutritional counseling.”

You absolutely cannot advertise guaranteed outcomes or success rates without peer-reviewed evidence, before-and-after photos without explicit written patient consent, comparative claims against other facilities without published research, fear-based messaging that exploits patient anxieties, or promotional content that contradicts cultural or religious values. Each violation risks advertising account suspension, DHA penalties, and potential license complications.

Cost benchmarks for healthcare advertising in Dubai run higher than global averages due to high competition and valuable patient lifetime value. While global healthcare advertising averages show cost-per-acquisition around $78 for search and $72 for display, Dubai healthcare CPAs typically run 30-40% higher.

Specialty clinics in competitive areas like cosmetic dermatology or fertility treatments might see CPAs of $150-250, while primary care and general practice CPAs stay in the $80-120 range.

Return on ad spend expectations should target 3:1 to 5:1 for established clinics with optimized conversion funnels. New facilities or highly specialized practices might accept 2:1 ROAS during patient acquisition phases, understanding that patient lifetime value will exceed initial acquisition costs.

I’ve managed Google Ads campaigns for Dubai dental clinics, achieving 4.5:1 ROAS and medical aesthetics centers hitting 6:1 ROAS, but those results required 4-6 months of optimization, rigorous landing page testing, and systematic conversion rate improvement.

Meta advertising for healthcare works best for awareness building and the consideration phase engagement rather than direct appointment booking.

I use Facebook and Instagram to establish authority through educational content, showcase facility environments and medical teams, promote health awareness campaigns aligned with Dubai Health Authority initiatives, and retarget website visitors who haven’t yet booked appointments.

The key is maintaining compliance while creating content that actually stops the scroll—challenging when you can’t use sensational claims or before-and-after transformations.

Content Marketing for Healthcare Authority

Educational content that doesn’t violate DHA guidelines focuses on condition education rather than treatment promotion, lifestyle factors and prevention strategies, health screening recommendations by age and risk factors, explanation of medical procedures and what patients should expect, and answers to common patient questions about symptoms and when to seek care.

The distinction matters: writing “5 Signs You Might Have Diabetes” is compliant educational content, while “Our Diabetes Treatment Cures Patients Faster” makes prohibited treatment claims without evidence.

Patient testimonials require explicit written consent, factual accuracy without exaggeration, and balanced presentation that doesn’t constitute misleading evidence or unrealistic outcome expectations.

I have healthcare clients collect video testimonials using structured scripts that share patient experiences without making medical claims. The patient talks about their comfort level, the professionalism of the staff, and their satisfaction with care, not specific treatment outcomes or cure claims. This approach satisfies DHA requirements while providing authentic social proof.

Video content regulations in Dubai healthcare are particularly strict. All video content must be reviewed for cultural appropriateness, medical accuracy, and compliance with advertising standards before publication.

I recommend healthcare providers create video content series including “Meet Our Specialists” introducing physicians and their qualifications, “Understanding Your Condition” educational series on common health issues, “Facility Tour” videos showing modern equipment and comfortable environments, and “Health Tips” short-form content for social media engagement.

Each video should include disclaimers where appropriate and avoid making therapeutic claims without proper authorization.

Conversion Rate Optimization for Healthcare Websites

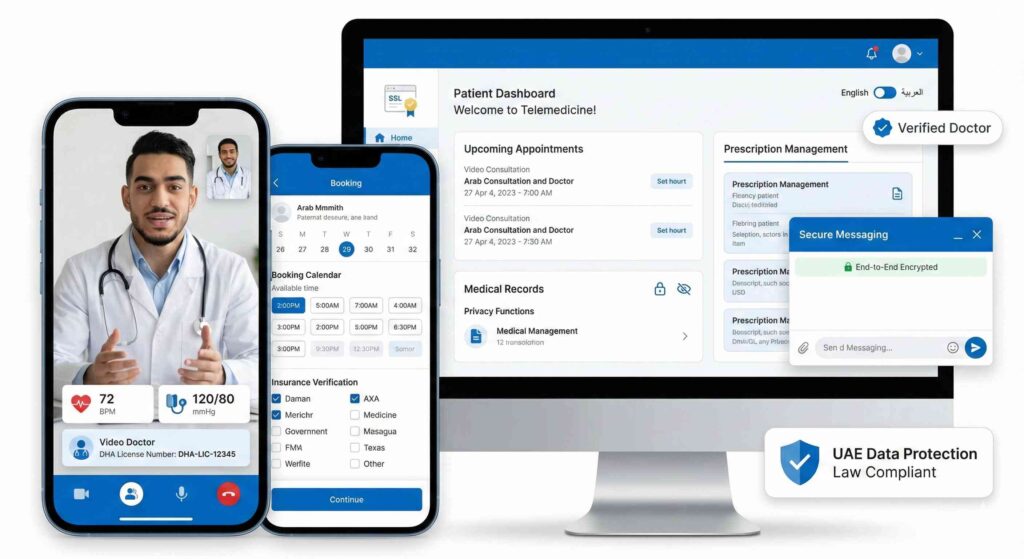

Online booking systems must comply with data protection requirements equivalent to HIPAA standards in the UAE. The UAE Data Protection Law and DHA patient confidentiality requirements mandate secure transmission of patient information, explicit consent for data collection and processing, and clear privacy policies explaining data usage and protection.

I implement SSL encryption, GDPR-compliant forms, and secure patient portals for all healthcare clients regardless of whether they’re legally required, because patient trust depends on visible security measures.

Mobile optimization is non-negotiable when 60% of healthcare searches happen on smartphones and tablets. Your mobile experience must include tap-to-call functionality prominently placed, simplified forms with minimal required fields, fast-loading pages under 3 seconds, clear navigation to key pages like services and contact, and a responsive design that adapts to any screen size.

I’ve seen conversion rates double just from fixing mobile experience issues on healthcare websites that were perfectly functional on desktop.

Trust signals specific to Dubai healthcare include prominently displaying DHA license numbers and expiration dates, showing international accreditations like JCI or other recognized bodies, featuring physician credentials with medical school, residency, and board certifications, listing insurance providers accepted at the facility, and including a physical address with parking information and public transport access.

Each trust element independently improves conversion rates, and the cumulative effect of complete trust presentation can increase appointment bookings by 50-70% compared to sites missing these signals.

Multilingual experience requires more than Google Translate integration. Complete Arabic language versions should use professional medical translation, maintain right-to-left text flow and design adaptations, ensure all forms and booking systems work in Arabic, and provide Arabic-speaking staff contact options.

Half-implemented Arabic support is worse than English-only because it signals a lack of attention to detail in a healthcare context where details literally save lives.

The 180% Lead Increase Strategy (First Medical Consultancy Case Study)

Let me walk you through the exact campaign that generated 180% more qualified medical professional leads for First Medical Consultancy, a Dubai-based medical recruitment and licensing agency. This wasn’t a theoretical strategy—it was a 4-month implementation that delivered 500+ qualified healthcare professional leads, reduced cost-per-application by 45%, and helped them fill 12 critical positions in a competitive GCC market.

The Healthcare Workforce Crisis in GCC

Understanding the context matters because it shaped our entire strategic approach. The GCC healthcare sector faces acute workforce shortages across nearly all specialties. Industry projections show a global shortage of 11 million healthcare workers by 2030, with the GCC region experiencing particularly intense competition for qualified professionals.

The UAE, Saudi Arabia, and Qatar all rely heavily on foreign-trained healthcare workers, creating ongoing recruitment demand that spans nursing, specialty physicians, allied health professionals, and administrative medical staff.

Medical licensing requirements vary significantly across GCC markets. A physician licensed in the UK must obtain DHA licensure to practice in Dubai, SCFHS registration for Saudi Arabia, Qatar Council for Healthcare Practitioners approval in Doha, and similar authorizations in other Gulf states.

Each licensing process involves credential verification, examination requirements, and documentation that takes weeks to months to complete. For healthcare professionals, navigating these requirements is overwhelming.

For medical recruitment agencies like First Medical Consultancy, this complexity represents the core value proposition: expertise in securing GCC medical licenses quickly and correctly.

The competitive landscape for medical recruitment in the GCC is intense. Agencies compete for the same pool of qualified international healthcare professionals, many of whom are researching multiple GCC opportunities simultaneously.

Conversion rates from initial inquiry to signed placement average only 5-8% across the industry because healthcare professionals are cautious, methodical, and compare offers extensively.

LinkedIn Marketing for Healthcare Professional Recruitment

LinkedIn became our primary acquisition channel because that’s where healthcare professionals actively present their credentials, career histories, and geographic mobility.

Our targeting strategy focused on medical specialty and certification rather than generic “healthcare” categories, current location in the UK, Ireland, India, the Philippines, and other key source markets, language capabilities including English and ideally Arabic, license status and willingness to relocate internationally, and engagement with healthcare content and GCC employment opportunities.

The content strategy for passive candidates required a complete shift from traditional job advertising. We developed a content calendar that included “Day in the Life” posts from healthcare professionals already working in Dubai, GCC licensing guides for each medical specialty with step-by-step processes, salary comparison infographics showing UAE vs home market compensation, cost of living breakdowns for Dubai and Abu Dhabi vs London or Mumbai, and success stories from healthcare professionals who successfully relocated through the agency.

Employee advocacy played a critical role. We trained First Medical Consultancy’s placement coordinators to share company content, engage with healthcare professional posts about career transitions, and participate in LinkedIn groups focused on international medical careers.

This personal engagement from real placement specialists built credibility that corporate advertising couldn’t achieve.

The results from LinkedIn marketing specifically included 312 qualified healthcare professional leads in 4 months, a cost-per-lead of AED 47 compared to AED 85 from previous general advertising, and 23% of LinkedIn leads converting to the application stage versus 11% from other sources. LinkedIn wasn’t just another channel—it was our highest-performing acquisition source throughout the campaign.

Google Ads for Medical Licensing Keywords

Simultaneously, we launched targeted Google Ads campaigns focused on high-intent licensing keywords. Healthcare professionals actively searching for “DHA license for doctors,” “MOH license Saudi Arabia,” “nursing license Dubai,” and similar terms are much further down the conversion funnel than passive LinkedIn audiences.

They’re researching specific licensing requirements right now, which indicates immediate or near-term relocation intent.

The search volume data revealed opportunities we hadn’t expected. “DHA medical license” averages 720 monthly searches, but long-tail variations like “DHA exam for doctors” and “DHA eligibility for physicians” combined for another 1,100+ searches monthly.

We built campaigns targeting 43 different licensing-related keywords across the UAE, Saudi Arabia, Qatar, and Oman markets.

Landing page strategy treated each GCC country as a separate conversion path. A physician searching for DHA licensing information received a Dubai-specific landing page with DHA process details, Dubai employment information, testimonials from physicians working in Dubai healthcare facilities, and next steps to start the DHA licensing process through First Medical Consultancy.

A similar search for Saudi SCFHS licensing received completely different content focused on Saudi market specifics.

Google Ads campaign performance delivered 188 qualified leads at AED 62 cost-per-lead, conversion rate of 19% from click to lead form submission, and average time from first click to application submission of 11 days.

The quick conversion timeline on Google Ads leads versus 6-8 week nurture cycles on LinkedIn leads demonstrated the intent difference between active searchers and passive professional audiences.

The Complete Campaign That Generated 180% More Leads

The integrated campaign combined LinkedIn passive outreach, Google Ads high-intent search capture, Meta retargeting for engagement maintenance, email nurture sequences with licensing information and success stories, and landing pages optimized for each GCC market and medical specialty. Each channel served specific purposes in the overall patient acquisition funnel.

The starting point before our engagement showed inconsistent monthly lead generation ranging from 40-75 leads, average cost-per-application above AED 150, a low application-to-placement conversion rate of 6%, and minimal tracking of lead source or campaign performance.

First Medical Consultancy was spending roughly AED 25,000 monthly on marketing, with poor visibility into what actually generated placements.

Our implementation timeline followed a systematic 4-month approach. Month one focused on campaign infrastructure, including landing page development for six GCC markets, LinkedIn campaign setup with professional targeting, Google Ads campaign launch for licensing keywords, and analytics implementation for proper attribution.

Month two emphasized optimization, including A/B testing, landing page variations, refining LinkedIn audience targeting, expanding Google Ads keyword coverage, and developing nurture email sequences.

Month three delivered scaling, including increasing budgets for top-performing campaigns, launching Meta retargeting campaigns, expanding content marketing efforts, and refining sales handoff processes. Month four concentrated on measurement, including full attribution analysis, cost-per-placement calculations, ROI documentation, and campaign sustainability planning.

The results breakdown showed 180% increase in qualified medical professional leads from an average of 57 monthly leads to 160 monthly leads by month four, 45% reduction in cost-per-application from AED 152 to AED 83 through better targeting and conversion optimization, 500+ total qualified healthcare professional leads generated across the 4-month campaign period, and 12 critical medical positions filled directly attributable to the new marketing system within 3 months.

Budget allocation across channels settled at 40% LinkedIn advertising for passive professional targeting, 30% Google Ads for active licensing keyword searches, 15% Meta retargeting and awareness campaigns, 10% content development and SEO foundation, and 5% analytics, attribution tools, and testing budget. This allocation emerged through systematic testing and performance measurement rather than arbitrary channel distribution.

The key optimizations that made the difference included landing page specialization by country and medical specialty rather than generic pages, nurture email sequences that educated rather than hard-sold, proper lead qualification criteria that focused sales team attention on high-intent prospects, and attribution tracking that showed true cost-per-placement beyond initial lead costs.

Many agencies measure success by leads generated, but First Medical Consultancy needed placements. Our focus on placement attribution and lifetime value changed how they viewed marketing ROI entirely.

Marketing Telemedicine Services in a Regulated GCC Environment

Telemedicine transformed from emerging technology to mainstream healthcare delivery during COVID-19, and that shift appears permanent across the GCC region.

Marketing virtual care services requires understanding both telemedicine-specific regulations and how patients perceive remote healthcare compared to traditional facility-based care.

Telemedicine Regulations in Dubai & GCC

DHA maintains specific virtual care guidelines that govern how telemedicine can be marketed and delivered in Dubai. Virtual healthcare providers must maintain Dubai Health Authority licensing for telemedicine services specifically, ensure physicians are individually licensed for virtual consultations, implement proper patient identification and verification protocols, maintain secure HIPAA-equivalent patient data handling, and clearly disclose limitations of virtual care versus in-person visits.

The Department of Health in Abu Dhabi requires separate telemedicine service licensing beyond standard healthcare facility licenses. This creates a compliance consideration for multi-emirate telemedicine platforms: your DHA approval doesn’t automatically transfer to Abu Dhabi operations.

I’ve worked with telemedicine platforms that assumed emirate reciprocity and faced service suspension when they discovered each emirate requires independent licensing and compliance verification.

Cross-border telehealth restrictions limit how GCC telemedicine providers can serve patients outside their licensed jurisdiction. A physician licensed in Dubai through the DHA cannot legally provide virtual consultations to patients physically located in Saudi Arabia without appropriate Saudi medical licensing.

For platforms marketing across GCC markets, this creates complex operational requirements where physician licensing must match patient location rather than platform availability.

Patient data privacy under the UAE Data Protection Law imposes requirements on telemedicine platforms, including explicit patient consent for data collection and processing, secure data transmission and storage with encryption, data retention policies and deletion protocols, and breach notification procedures if patient data is compromised.

These aren’t just best practices—they’re legal requirements with enforcement mechanisms including fines and platform suspension.

Digital Health Platform Marketing Strategies

App store optimization for medical apps faces unique challenges. Apple App Store and Google Play Store have strict healthcare app review processes that examine medical claim accuracy, privacy policy completeness, and compliance with local regulations.

Your app description must avoid making therapeutic claims without proper authorization, clearly explain data collection and usage, include appropriate medical disclaimers, and specify geographic availability and regulatory compliance by market.

When I optimize app store listings for healthcare platforms, the compliance review takes longer than the actual optimization. We’re not just optimizing for downloads—we’re ensuring every word in the app description, every screenshot caption, and every feature claim complies with DHA standards, app store medical app policies, and truth in advertising requirements. One rejected submission can delay launch by weeks.

Patient education versus service promotion represents a critical distinction in healthcare app marketing. Educational content about health conditions, symptom recognition, and when to seek medical care is generally permissible and highly valuable for app store optimization.

Promotional content promising treatment outcomes, comparing your service against competitors, or making medical claims requires proper authorization and evidence. The marketing that performs best balances both: educating users on health topics while naturally positioning your platform as the solution for accessing care.

Integration with insurance providers matters enormously in GCC healthcare app marketing because mandatory health insurance coverage means patients actively seek covered services. The GCC health insurance market reached $18.4 billion in 2024, growing at 5.3% annually, with increasing numbers of insurance plans covering telemedicine consultations.

Apps that clearly list accepted insurance providers, enable insurance verification before consultation, and streamline claims submission see significantly higher conversion rates than platforms requiring cash payment.

Remote Patient Monitoring Marketing

B2B versus B2C marketing approaches require completely different strategies for remote patient monitoring platforms. Hospital partnerships and provider networks need enterprise sales approaches focusing on integration capabilities with existing EMR systems, compliance with hospital data security standards, ROI documentation for healthcare administrators, and physician training and adoption support.

Direct-to-consumer marketing for chronic disease patients emphasizes ease of use for non-technical users, affordability and insurance coverage, connection to their existing care team, and health outcome improvements with testimonials where permitted.

Chronic disease management positioning works exceptionally well in GCC markets where diabetes prevalence is among the world’s highest and cardiovascular disease rates continue rising.

Marketing remote monitoring for diabetes management, cardiac monitoring after events, hypertension tracking, and respiratory condition monitoring aligns with both patient needs and government health initiatives promoting preventive care and chronic disease management.

Wearable integration messaging has evolved beyond simple fitness tracking. Today’s remote monitoring platforms integrate with medical-grade wearables that track blood glucose continuously, ECG monitoring for cardiac patients, blood pressure tracking with automatic physician alerts, and oxygen saturation monitoring for respiratory conditions.

Marketing must distinguish between consumer fitness devices and medical-grade monitoring equipment while staying compliant with medical device advertising regulations.

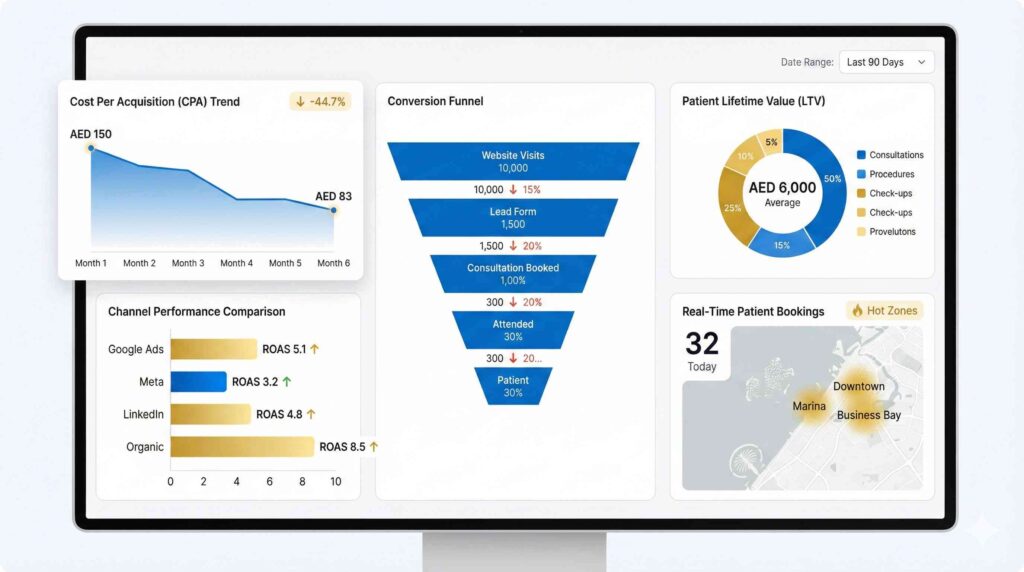

The Metrics That Actually Matter (Not Vanity Numbers)

Most healthcare marketers track the wrong metrics. They measure website traffic, social media followers, and email open rates—metrics that might correlate with business outcomes but don’t directly drive revenue or patient volume.

After managing AED 45,000+ in monthly advertising budgets across healthcare campaigns, I focus on five metrics that directly predict marketing ROI.

Essential Healthcare Marketing KPIs

Cost Per Acquisition tracks how much you spend to acquire one new patient. Calculate it by dividing the total marketing spend by the new patients acquired in the same period. If you spent AED 20,000 on marketing in March and acquired 150 new patients that month, your CPA is AED 133.

Industry benchmarks show healthcare CPA averaging $78 for search advertising and $72 for display globally, but Dubai market CPAs run 30-40% higher due to competition and valuable patient lifetime value in the region.

Patient Lifetime Value estimates the total revenue one patient generates throughout their entire relationship with your healthcare facility. For a primary care clinic, a patient might visit 3 times annually at AED 300 per visit for 5 years, generating AED 4,500 in lifetime value.

For a specialized clinic like fertility treatment, a single patient might generate AED 40,000-60,000 through a complete treatment cycle. Understanding LTV is essential because it determines how much you can afford to spend on acquisition. A patient worth AED 5,000 over their lifetime justifies higher acquisition costs than a patient worth AED 500.

The ideal ratio between Patient Acquisition Cost and Patient Lifetime Value is 1:3 minimum. If your average patient generates AED 6,000 in lifetime value, your maximum sustainable CPA is AED 2,000.

Operating above this ratio means you’re spending more to acquire patients than they’ll ever generate in revenue. Healthcare providers with strong LTV: CPA ratios can outspend competitors in advertising auctions, acquire more patients, and still maintain profitability.

Conversion Rate by Channel reveals which marketing sources generate the highest proportion of actual appointments from initial traffic or leads. Your Google Ads might drive 1,000 website visits with 50 appointment bookings for a 5% conversion rate, while Facebook referral traffic delivers 500 visits with only 10 bookings for a 2% conversion rate.

This tells you Google Ads traffic is higher quality and likely worth higher cost-per-click bids. I track conversion rates at every funnel stage, including website visitor to contact form submission, contact form to phone consultation, phone consultation to appointment booking, and appointment booking to completed visit.

Retention Rate measures how effectively you keep patients returning for ongoing care. Retaining existing patients costs 5x less than acquiring new ones, and the likelihood of reselling to an existing patient is 60-70% compared to 5-20% for new patients.

Healthcare marketers focused exclusively on acquisition miss the enormous value in retention marketing through email campaigns promoting preventive care visits, birthday and wellness check reminders, education on new services your facility offers, and re-engagement campaigns for patients who haven’t visited in 6-12 months.

Attribution Challenges in Healthcare Marketing

Multi-touch patient journeys create attribution complexity because patients interact with your brand across an average of 15 touchpoints before booking their first appointment. They might see your Facebook ad, visit your website, read online reviews, receive a referral from their primary care doctor, return to your website from a Google search, and finally book an appointment by phone.

Which touchpoint gets credit for that patient acquisition? First-touch attribution credits the initial Facebook ad. Last-touch attribution credits the final Google search. Multi-touch attribution distributes credit across all interactions based on contribution to conversion.

I use position-based attribution for most healthcare clients because it appropriately weights both first touch (awareness) and last touch (conversion) while acknowledging middle interactions.

In practice, this means if a patient’s journey included Facebook ad → website visit → Google search → phone call → appointment, the attribution model gives 30% credit to Facebook, 10% to the first website visit, 30% to the Google search, and 30% to the phone call conversion.

Offline to online tracking remains challenging in healthcare, where phone calls still represent 40-60% of appointment bookings in Dubai markets. Call tracking software with dynamic number insertion allows you to assign unique phone numbers to each marketing channel and even specific campaigns.

When a patient calls the number displayed on your Google Ad, you know that lead source. When they call the number from your Facebook page, you attribute that lead correctly. Without call tracking, all phone bookings show as “direct” in analytics, obscuring your most effective channels.

HIPAA-equivalent compliance in tracking requires careful implementation. You cannot pass personally identifiable patient information through analytics platforms, advertising pixels, or third-party tools without explicit consent and proper data protection.

I configure healthcare analytics using anonymous user IDs rather than names or contact information, hash email addresses before passing to advertising platforms, exclude protected health information from all tracking tags, and implement strict data retention policies that delete patient journey data after attribution is complete.

Tools & Systems for Healthcare ROI Tracking

Healthcare CRM integration with EMR systems creates complete patient acquisition visibility from the first marketing touchpoint through ongoing care and revenue generation.

When your CRM connects to your electronic medical records, you can calculate true patient lifetime value, including all visits, procedures, and revenue generated. This enables accurate ROI measurement that goes beyond initial appointment booking to actual financial outcomes.

Call tracking for phone bookings should integrate with your CRM so phone lead attribution flows into the same system as web form submissions and chat conversations. I use call tracking platforms that record calls for quality assurance, transcribe conversations for keyword analysis, automatically log calls in the CRM, and integrate with Google Ads for offline conversion tracking.

Google Analytics 4 for healthcare requires proper configuration to maintain compliance while gathering useful insights. Healthcare-specific GA4 setup includes enabling IP anonymization to protect patient privacy, disabling data sharing with Google for advertising purposes, excluding patient portal pages from analytics tracking, implementing strict user ID and consent management, and creating custom events that track marketing effectiveness without collecting protected information.

Attribution software for patient journey mapping helps you understand the complex path patients take from awareness to appointment. Platforms like HubSpot for healthcare, Salesforce Health Cloud, or specialized healthcare attribution tools track every patient interaction across channels, calculate multi-touch attribution credit, measure channel effectiveness, identify highest-value patient sources, and provide ROI visibility for marketing budget allocation.

Real Numbers from Dubai Healthcare Campaigns

The First Medical Consultancy campaign I detailed earlier achieved 45% cost-per-application reduction from AED 152 to AED 83 through systematic optimization. That’s not an outlier—it’s what happens when you move from spray-and-pray advertising to strategic, measured campaigns with proper attribution.

Dubai Healthcare CPA Benchmarks by Specialty:

| Healthcare Specialty | Average CPA Range (AED) | Patient LTV Range (AED) | Sustainable CPA:LTV Ratio |

|---|---|---|---|

| Primary Care & General Practice | 80-150 | 3,000-5,000 | 1:20 to 1:33 |

| Dental Clinics | 100-180 | 4,000-8,000 | 1:22 to 1:80 |

| Medical Aesthetics | 200-400 | 8,000-15,000 | 1:20 to 1:75 |

| Fertility Treatment | 300-600 | 30,000-50,000 | 1:50 to 1:167 |

| Orthopedic Surgery | 300-600 | 25,000-40,000 | 1:42 to 1:133 |

| Cardiology | 250-500 | 20,000-35,000 | 1:40 to 1:140 |

Dubai healthcare CPA ranges vary dramatically by specialty and competition. Primary care and general practice CPAs typically run AED 80-150 for new patient acquisition. Dental clinics average AED 100-180, depending on services promoted and location.

Medical aesthetics and cosmetic procedures can justify CPAs of AED 200-400, given high procedure values. Specialized clinics like fertility treatment or orthopedic surgery might see CPAs of AED 300-600 but patient lifetime values of AED 30,000-50,000 that make those acquisition costs highly profitable.

Expected ROI timelines differ by marketing channel. Paid advertising through Google Ads or Meta delivers immediate results within days of campaign launch, though optimization to peak performance takes 4-8 weeks. Local SEO shows meaningful improvement in 2-3 months for Google Business Profile optimization and local pack rankings.

Organic SEO requires 4-6 months before significant traffic increases, but continues delivering long-term compounding value. Content marketing and email nurture build momentum over 6-12 months as libraries of helpful content accumulate and email lists grow.

Healthcare Marketing Channel Performance Timeline:

| Marketing Channel | Time to First Results | Time to Peak Performance | Sustainable ROI Range | Best For |

|---|---|---|---|---|

| Google Ads | 24-48 hours | 4-8 weeks | 3:1 to 5:1 | Immediate patient volume |

| Meta Ads (Facebook/Instagram) | 3-7 days | 6-10 weeks | 2:1 to 4:1 | Awareness & retargeting |

| LinkedIn Ads (B2B/Recruitment) | 5-10 days | 8-12 weeks | 4:1 to 6:1 | Medical recruitment |

| Local SEO (Google Business) | 2-3 months | 6-9 months | 5:1 to 8:1 | Local patient acquisition |

| Organic SEO (Content/Rankings) | 4-6 months | 12-18 months | 8:1 to 15:1 | Long-term authority |

| Email Marketing | 1-2 months | 6-12 months | 10:1 to 20:1 | Patient retention |

| Content Marketing | 3-6 months | 12-24 months | 6:1 to 12:1 | Thought leadership |

Contribution margin analysis by service line reveals which healthcare services generate the highest profitability after marketing costs. If your orthopedic clinic offers both general consultations at AED 400 average revenue and specialized joint replacement procedures at AED 35,000 average revenue, you’d obviously allocate more marketing budget toward joint replacement patient acquisition despite potentially higher CPAs.

The contribution margin—revenue minus variable costs, including marketing spend—on joint replacement vastly exceeds the general consultation margin, making it the priority for marketing investment.

My Complete Framework for GCC Healthcare Marketing

Building a sustainable healthcare marketing system requires more than running some ads and hoping for results. After years of managing comprehensive campaigns across Dubai and the broader GCC region, I’ve developed a framework that integrates compliance, technology, content, and measurement into one cohesive system.

The Full-Stack Healthcare Marketing Tech Stack

Building a sustainable healthcare marketing system requires more than running some ads and hoping for results. After years of managing comprehensive campaigns across Dubai and the broader GCC region, I’ve developed a framework that integrates compliance, technology, content, and measurement into one cohesive system.

Essential Healthcare Marketing Technology Stack:

☐ Website Platform (HIPAA-equivalent compliant)

- Secure patient data transmission and storage

- Multi-language content management (English + Arabic minimum)

- Online appointment booking with calendar integration

- Mobile-responsive design optimized for healthcare

- Compliance-ready consent management

☐ Healthcare CRM System

- Patient intake form integration

- Appointment scheduling and reminder automation

- Treatment plan tracking and follow-up sequences

- Insurance verification and authorization tracking

- HIPAA-compliant data handling with audit trails

- Physician referral management and coordination

☐ Marketing Automation

- Appointment reminder emails and SMS (with consent)

- Educational email sequences on health topics

- Birthday and annual checkup reminder campaigns

- Patient satisfaction surveys post-visit

- Re-engagement campaigns for inactive patients

☐ Social Media Management

- Content calendar with DHA compliance review

- Approval workflows for medical content

- Comment monitoring for patient questions

- Compliance documentation for audit trails

☐ Analytics & Reporting Dashboard

- Website analytics (traffic sources, conversion paths)

- Advertising platform performance (Google, Meta, LinkedIn)

- Call tracking data for offline conversions

- CRM data (lead sources, patient acquisition costs)

- Revenue data tied back to marketing sources

Website platform selection for healthcare requires specific capabilities beyond standard business websites. Your healthcare website platform must support HIPAA-equivalent security and data protection, multi-language content management for English and Arabic, online appointment booking with calendar integration, secure patient forms with encrypted data transmission, compliance-ready consent management, and mobile-responsive design optimized for healthcare user experience.

CRM systems with healthcare features go beyond generic contact management. Healthcare CRMs should include patient intake form integration, appointment scheduling and reminder automation, treatment plan tracking and follow-up sequences, insurance verification and authorization tracking, HIPAA-compliant data handling with audit trails, and physician referral management and coordination.

I’ve implemented healthcare CRMs for clients ranging from single-location clinics to multi-facility groups, and the efficiency gains in patient communication and retention typically pay for the system within 3-4 months.

Marketing automation for healthcare requires careful consent management and compliance consideration. You can automate appointment reminder emails and SMS with proper patient consent, educational email sequences on health topics and preventive care, birthday and annual checkup reminder campaigns, patient satisfaction surveys post-visit, and re-engagement campaigns for patients who haven’t visited recently.

What you cannot do is send promotional emails without explicit opt-in consent or share patient health information through marketing automation tools without proper data protection.

Social media management with compliance monitoring means reviewing every post before publication for DHA compliance, maintaining approval workflows for medical content, monitoring comments for patient questions requiring careful responses, and documenting all compliance checks for audit trails.

I use content calendars that build in 48-hour review windows between content creation and publication, allowing time for compliance verification without disrupting posting schedules.

Analytics and reporting dashboards should consolidate data from multiple sources including website analytics showing traffic sources and conversion paths, advertising platform performance across Google, Meta, and LinkedIn, call tracking data for offline conversions, CRM data showing lead sources and patient acquisition costs, and revenue data tied back to marketing sources for true ROI calculation. One dashboard with all this data is worth more than ten separate platform logins.

Content Calendar for Healthcare Brands

Educational content ratio versus promotional content should favor education heavily. I target 80% educational and informative content to 20% promotional for healthcare social media and email marketing. Patients engage with helpful health information, seasonal wellness tips, and medical myth debunking far more than they engage with service promotions.

The educational content builds trust and authority, making the occasional promotional content more effective when you do share it.

Seasonal healthcare topics in Dubai include Ramadan health and fasting safely for patients with chronic conditions, summer heat safety and hydration for children and elderly patients, flu season preparation and vaccination campaigns in fall months, back-to-school health screenings and vaccination requirements, and year-end insurance benefits utilization reminders before coverage resets. These seasonal topics align with actual patient concerns and search behavior, generating higher engagement than generic evergreen content.

Compliance review workflow should include content creator drafts initial content following DHA guidelines, healthcare compliance specialist reviews for medical accuracy and regulatory compliance, legal review for high-risk content like treatment comparisons or outcome claims, physician review and approval for medical content, and final publication approval from marketing leadership.

This might seem like overkill, but one DHA violation costing AED 100,000 in fines justifies robust review processes for every piece of content.

Multilingual content management requires more than translation tools. Professional Arabic translation for all major content ensures accuracy and cultural appropriateness. Content creation directly in Arabic by native speakers often works better than English-first translation.

Cultural adaptation of images, examples, and messaging maintains relevance. Separate approval workflows for Arabic content with Arabic-speaking compliance reviewers prevent translation-based compliance issues.

Team Structure vs Agency vs Freelancer

In-house healthcare marketers provide deep industry knowledge and compliance expertise but require full-time salaries, benefits, and overhead. For larger healthcare groups with multiple locations or significant marketing budgets above AED 50,000 monthly, in-house teams often make financial sense.

They develop institutional knowledge, understand your patient population intimately, and maintain consistent brand messaging.

Healthcare Marketing Approach Comparison:

| Approach | Monthly Cost (AED) | Compliance Expertise | Integration Quality | Best For | Key Limitation |

|---|---|---|---|---|---|

| Traditional Agency Setup | 30,000-60,000+ | ⚠️ Varies widely | ❌ Poor (fragmented) | Large budgets | Lack of coordination |

| In-House Team | 25,000-45,000 (salary + overhead) | ✅ Can be developed | ✅ Excellent | Multi-location groups | High fixed costs |

| Freelance Specialists | 15,000-35,000 | ⚠️ Hit or miss | ❌ Requires management | Specific projects | Coordination burden |

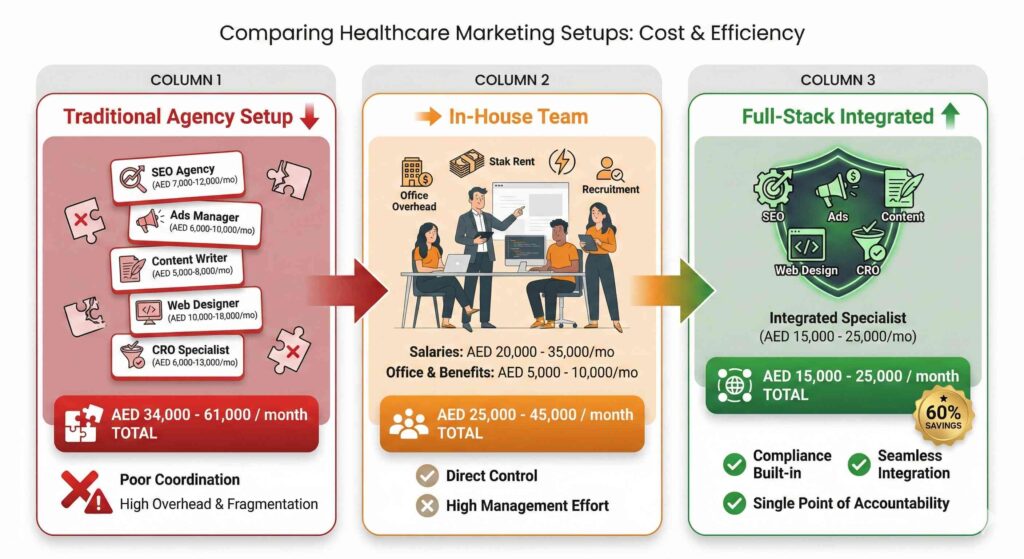

| Full-Stack Integrated | 15,000-25,000 | ✅ Built-in | ✅ Seamless | Most healthcare businesses | Limited team size |

Traditional agency limitations in healthcare marketing center on lack of specialized compliance knowledge and experience navigating DHA, MOHAP, and GCC-specific regulations.

General digital marketing agencies understand Google Ads and social media, but don’t know healthcare advertising restrictions. They produce beautiful campaigns that violate DHA guidelines and expose clients to fines and license complications.

When evaluating agencies, I look for healthcare portfolio depth, specific GCC healthcare experience, compliance processes and review workflows, and references from Dubai healthcare clients.

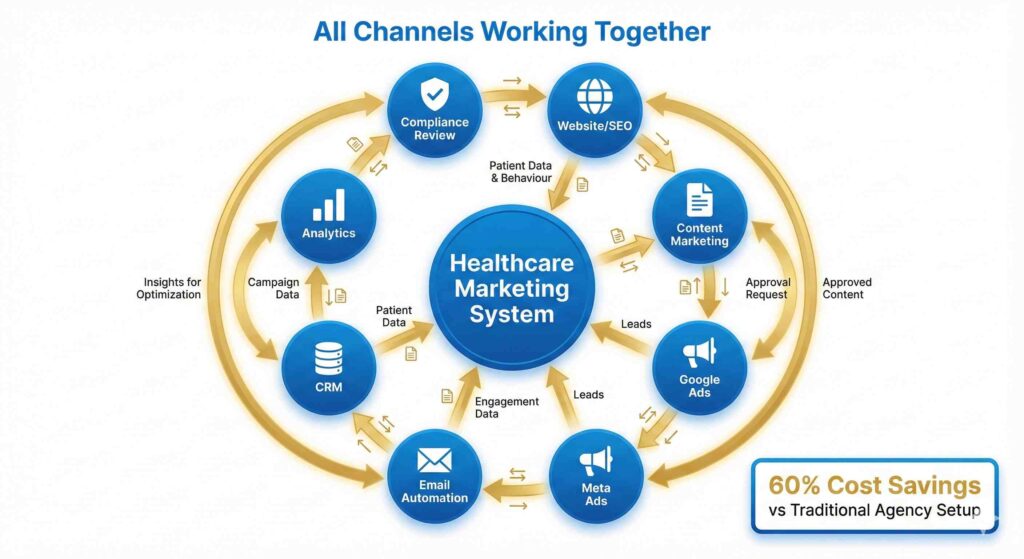

The full-stack specialist approach—my model—replaces SEO agencies, content writers, web designers, paid advertising managers, and CRO specialists with one integrated system.

Most Dubai healthcare businesses pay AED 30,000+ monthly, coordinating five different agencies and vendors. The SEO team doesn’t talk to the ads team. Landing page designers don’t coordinate with content writers.

You end up with Frankenstein marketing that costs a fortune and delivers mediocre results. I replaced that entire fragmented setup with one integrated system at 60% lower cost where everything works together from day one.

The cost comparison looks like this: Traditional agency setup costs AED 8,000-12,000 for SEO agency monthly retainer, AED 10,000-20,000 for Google Ads management plus ad spend, AED 5,000-8,000 for social media management, AED 8,000-15,000 for content creation and copywriting, plus AED 3,000-6,000 for web development and maintenance.

Total monthly investment: AED 34,000-61,000 before ad spend. Full-stack integrated approach delivers all these services for AED 15,000-25,000 monthly, including coordination, strategy, and compliance oversight.

Common Mistakes Dubai Healthcare Businesses Make

❌ MISTAKE 1: Copying International Campaigns Without Localization

Copying international campaigns without localization is the fastest way to waste marketing budgets. A campaign that works brilliantly in London or Sydney needs complete adaptation for Dubai’s regulatory environment, cultural context, and competitive landscape.

The messaging, imagery, channels, and calls-to-action all require localization. I’ve seen healthcare clients waste AED 50,000+ running international campaigns that violated DHA guidelines and generated zero qualified leads.

❌ MISTAKE 2: Ignoring the Arabic-Speaking Audience

Ignoring the Arabic-speaking audience eliminates access to 55% of UAE residents who prefer consuming healthcare content in Arabic. Even multilingual residents often search for health information in their native language.

Healthcare websites and campaigns that don’t serve Arabic speakers are leaving enormous patient volume on the table. The fix isn’t difficult—professional translation and Arabic content creation costs less than the patient lifetime value you’re missing.

❌ MISTAKE 3: Fear-Based Marketing

Fear-based marketing violates both DHA rules and medical ethics but remains common in healthcare advertising. Messages like “Don’t wait until it’s too late” or “Ignoring this symptom could be fatal” use fear to coerce patients into seeking care.

The DHA explicitly prohibits this approach. Effective healthcare marketing educates and informs without exploiting patient anxieties.

❌ MISTAKE 4: Comparing Competitors Without Evidence

Comparing competitors without peer-reviewed evidence creates compliance violations even when your comparisons are factually accurate. You cannot claim your clinic is “better,” “safer,” or “more advanced” than other Dubai healthcare providers unless you have published research supporting each element of that comparison.

Focus your messaging on your own capabilities, qualifications, and outcomes rather than competitive comparisons.

❌ MISTAKE 5: Using Unauthorized Logos or Endorsements

Using unauthorized logos or endorsements happens frequently with healthcare marketers who don’t understand DHA restrictions. You cannot display the DHA logo, MOHAP insignia, or other government healthcare authority branding without explicit written permission.

Claiming government endorsement, approval, or recommendation when you only have standard licensing is prohibited and results in immediate violations.

❌ MISTAKE 6: No Mobile Optimization

No mobile optimization despite 60% of healthcare searches happening on mobile devices undermines conversion rates dramatically. Patients searching “pediatrician near me” on their phones while their child is sick need instant access to your location, hours, phone number, and appointment booking.

If your website takes 8 seconds to load on mobile or requires zooming and scrolling to read content, those patients are booking with your competitor before your page even finishes loading.

❌ MISTAKE 7: Focusing on Vanity Metrics

Focusing on vanity metrics instead of patient acquisition wastes time and misdirects strategy. Social media follower counts, website traffic totals, and email open rates are interesting but don’t directly generate revenue.

I’ve seen healthcare businesses celebrate 10,000 Instagram followers while patient volume declined because none of those followers converted to appointments.

Track metrics that predict revenue: cost per patient acquisition, conversion rates by channel, patient lifetime value, and actual appointments booked from marketing sources.

Healthcare Marketing in GCC: Your Questions Answered

What is healthcare marketing authority, and why does it matter for Dubai businesses?

Healthcare marketing authority refers to your facility’s credibility, expertise, and trustworthiness as evaluated by both potential patients and search engines like Google. In healthcare specifically, Google evaluates content and websites using E-E-A-T criteria: Experience, Expertise, Authoritativeness, and Trustworthiness. Your marketing authority determines whether Google ranks your content highly in search results, whether patients trust your facility enough to book appointments, and whether you can command premium pricing for services.

Authority matters enormously in Dubai’s competitive healthcare market because patients research extensively before choosing providers. Approximately 60% of patients conduct online research before booking healthcare appointments, reading reviews, checking credentials, comparing facilities, and evaluating expertise signals. Healthcare providers with strong authority signals convert these researching patients at rates 2-3x higher than facilities lacking authority markers.

Building a healthcare authority requires consistently publishing accurate, helpful medical content, showcasing physician credentials and qualifications prominently, earning positive patient reviews and testimonials, obtaining international healthcare accreditations, and maintaining active engagement with patient questions and concerns. These authority signals compound over time—facilities that invested in authority building years ago now dominate local search results and patient acquisition in their specialties.

How much does healthcare marketing typically cost in Dubai?

Healthcare marketing costs in Dubai vary significantly based on specialty, competition, and strategy mix, but here are realistic benchmarks across key channels. SEO and content marketing typically cost AED 5,000-15,000 monthly for professional optimization, content creation, and technical improvements. Results take 4-6 months to materialize but provide long-term compounding value.

Google Ads management runs AED 10,000-50,000 monthly, including management fees plus advertising spend, with higher costs for competitive specialties like cosmetic procedures or fertility treatment. Results are immediate, but stop when spending stops. Social media marketing costs AED 3,000-10,000 monthly for content creation, community management, and compliance-ready posting across Facebook, Instagram, and LinkedIn.

Full-stack integrated approaches that replace multiple vendors typically cost AED 15,000-25,000 monthly and include SEO, paid advertising management, content creation, web development, analytics and reporting, and compliance oversight. This represents 60% cost savings compared to coordinating separate agencies for each function while delivering better results through integrated strategy.

ROI expectations vary by timeline and channel. Paid advertising delivers 3:1 to 5:1 return on ad spend for established clinics with optimized conversion funnels. Organic SEO generates 5:1 to 10:1 long-term ROI once rankings are established. Full patient acquisition systems typically break even within 90 days and achieve 4:1+ ROI by month six through systematic optimization.

Cost per patient acquisition benchmarks by specialty include AED 80-150 for primary care and general practice, AED 100-180 for dental clinics, depending on services and location, AED 200-400 for medical aesthetics and cosmetic procedures, and AED 300-600 for specialized services like fertility treatment or orthopedic surgery. Higher CPAs are sustainable when patient lifetime value justifies acquisition investment.

What are the main benefits of strategic healthcare marketing for UAE companies?

Predictable patient pipeline replaces reliance on walk-ins, referrals, and word-of-mouth with systematic patient acquisition you can forecast and scale. Healthcare facilities with mature marketing systems know exactly how many patients they’ll acquire next month based on marketing spend and historical conversion rates. This predictability enables capacity planning, staff scheduling, and revenue forecasting impossible with sporadic patient flow.

Measurable ROI of 3-5x when executed correctly means every dirham invested in marketing returns AED 3-5 in patient revenue. The First Medical Consultancy campaign I managed generated 180% more leads at 45% lower cost per lead, delivering approximately 6:1 ROI when measured against placement fee revenue. This isn’t exceptional—it’s what proper healthcare marketing achieves consistently.

Brand authority in competitive specialties allows you to command premium pricing, attract more qualified patients, and reduce price sensitivity in patient decision-making. Facilities recognized as authorities in their specialties compete on quality and outcomes rather than price alone. This attracts higher-value patients and improves overall profitability.

Multi-location expansion capability becomes possible when you have systematic marketing that works in one location and can be replicated to new facilities. Healthcare groups opening second, third, and fourth locations can accelerate patient acquisition by applying proven marketing systems rather than building brand awareness from scratch in each market.